Top Online Casino Deutschland 2025: Die Besten Anbieter im Test

- July 14th, 2025

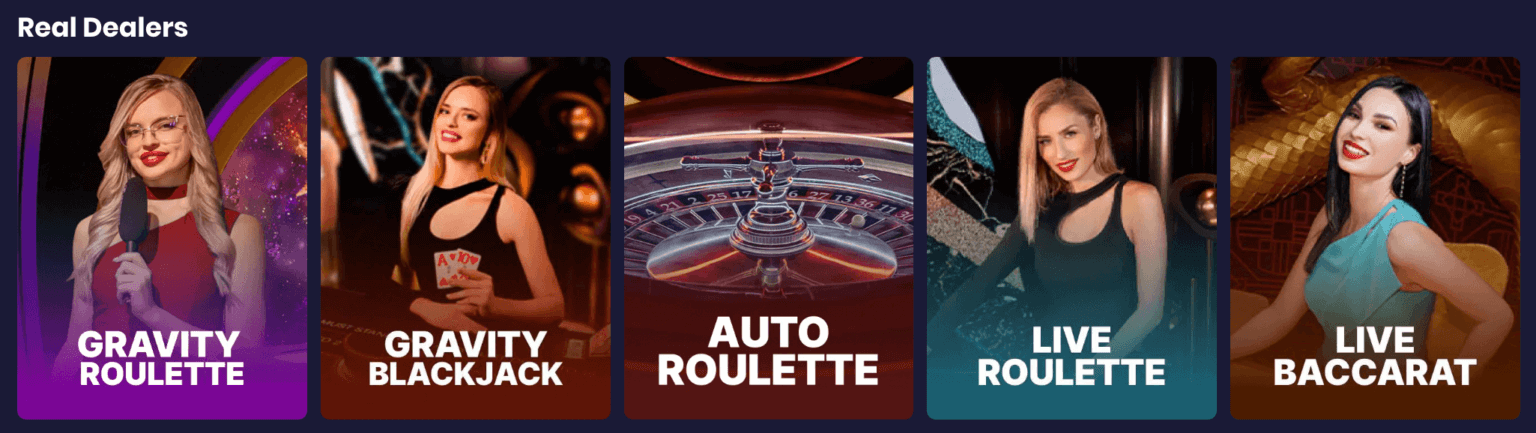

Auch Live-Casino-Erlebnisse, die Spieler durch Echtzeit-Interaktionen mit Dealern und anderen Spielern fasziniert haben, gehören der Vergangenheit an. Die besten Online Casinos in Deutschland bieten attraktive Bonusangebote, die jedoch strengen Umsatzbedingungen unterliegen. Diese Angebote sollten realistische Umsatzbedingungen und spielerfreundliche Anforderungen beinhalten, um den Spielern eine echte Chance auf Gewinne zu bieten. Neospin zeichnet sich durch attraktive Boni für neue und bestehende Spieler aus, die das Spielerlebnis noch lohnenswerter machen. Sind Sie auf der Suche nach legalen und sicheren Online-Casinos in Deutschland?

Tischspiele & Live-Dealer Spiele

Diese neuen Online Casinos, die seit kurzem auf dem Markt sind, bieten eine Menge Vorteile, die wir Ihnen gerne erläutern möchten. Wir haben deshalb einen ausführlichen Artikel erstellt, um Ihnen alle Vor- und Nachteile dieser neuen Online Casinos zu erklären. Hier ist eine kleine Zusammenfassung, warum Sie sich für eines dieser neuen Online Casinos, die brandneu auf dem Markt sind, entscheiden sollten.

Im Live Casino mit echten Croupiers spielen

Auch sollte man prüfen, ob Ein- und Auszahlung über denselben Kanal erfolgen müssen. Wer per Klarna einzahlt, kann in vielen Fällen nur per Banküberweisung auszahlen lassen. Gerade neue Spieler im casino online deutschland Umfeld werden hier abgeholt – es braucht keine Strategie, nur Aufmerksamkeit und ein bisschen Glück. Ein bestes online casino führt nicht nur klassische Varianten, sondern auch exklusive Blackjack-Tische mit deutschsprachigen Dealern und VIP-Support.

- Bei der Nutzung von PayPal stehen Spielern ein piratenstarkes Neukundenangebot zur Verfügung.

- Wir bewerten die beliebtesten und besten Casinos in Österreich, unabhängig davon, ob sie eine internationale oder eine lokale Lizenz besitzen.

- Damit Sie immer über Neuerungen und Entwicklungen auf dem iGaming Markt informiert sind, finden Sie hier aktuelle Neuigkeiten.

- Auch in der Schweiz sind Live Casinos bei vielen Spielern heißt begehrt.

Welche Zahlungsmethoden sind in deutschen Online Casinos verfügbar?

Da nicht viele Spieler so hohe Umsätze generieren, zahlen Schweizer Casino Spieler in der Regel keine Steuern auf ihre Gewinne. Wir empfehlen Ihnen aber dennoch, vor dem ersten Einsatz winrolla slots einen Blick in die AGB der beste Schweizer Online Casinos zu werfen. Wenn Sie unseren Ratgeber bis hierhin aufmerksam gelesen haben, wissen Sie nun, worauf unsere Experten beim Online Casino Schweiz Test achten. Wir haben Ihnen erklärt, welche Kriterien wir für den Vergleich berücksichtigen und wie Sie einen seriösen Anbieter finden, der perfekt zu Ihnen passt. Die Experten aus unserer Redaktion sind täglich auf den unterschiedlichen Webseiten unterwegs, um Ihnen die besten Online Casinos für Spieler in der Schweiz vorstellen zu können. Hier überprüfen wir jeden Anbieter anhand der eben vorgestellten Kriterien.

Genau ein Jahr später hat die Gemeinsame Glücksspielbehörde der Länder ihre operativen Tätigkeiten aufgenommen und ist seit dem 1. Januar 2023 vollumfänglich für die im Staatsvertrag beschriebenen Aufgaben zuständig. Weil Ihre Zeit kostbar ist, ist schnelle und kompetente Hilfe eine Selbstverständlichkeit. Ein Online Casino, das seine Spieler wie VIPs behandelt, lässt sie nicht lange auf ihre Gewinne warten. Im Rahmen unserer Tests haben wir mehrere Auszahlungen durchgeführt und die Bearbeitungsgeschwindigkeit bewertet.

Wichtig ist, die Umsatzbedingungen zu prüfen – diese liegen meist zwischen 30x und 40x. Auch die Gültigkeitsdauer spielt eine Rolle, da Boni großteils innerhalb von 7 bis 30 Tagen genutzt werden müssen. Bingo ist ein einfaches und geselliges Spiel, das in Online Casinos in verschiedenen Varianten angeboten wird. Spieler markieren gezogene Zahlen auf ihren Karten und versuchen, bestimmte Muster zu vervollständigen. Ziel ist es, mit zwei oder drei Karten möglichst nah an neun Punkte zu kommen. Besonders beliebt ist die Wette auf den Banker, da sie mit einer RTP von rund 98,94 % die besten Chancen bietet.

Zet Online Casino Simply No Down Payment Reward 12 Free Of Charge Spins

- July 14th, 2025

This Specific slot machine game device provides the particular standard assortment regarding bonuses, which includes 12 totally free spins on God’s Brow. Simply No, you will typically not really want a promotional code to end upward being able to get typically the totally free reward or take away earnings. Even though a few folks may not acknowledge, obtaining the particular maximum limit added bonus is usually not necessarily always a plus.

Exactly Where Could I Obtain No Downpayment Free Of Charge Spins?

- With Regard To example, along with your own 200 free of charge spins, slot machines possess a weighting of 100%, and then every dollar an individual bet will depend toward the particular wagering requirements.

- In the circumstance associated with simply no deposit deals, we all analyzed a bunch of these sorts of gives direct to independent the really useful kinds through elegant advertising methods.

- In Case a person would like in order to find out just what otherwise it offers to be capable to offer you, read upon regarding my complete ZetCasino review.

- The greatest extent bet need to furthermore be close to $5 thus of which actually as a higher painting tool, the particular limitations do not seem too small for your current design of perform.

Many players choose for internet casinos together with interesting no-deposit reward alternatives, generating these internet casinos very sought after. Any Time analyzing the particular finest free of charge spins simply no down payment casinos for 2025, a amount of criteria are regarded, including reliability, typically the quality of promotions, in add-on to customer https://www.zet-casino-ca.com assistance. Typically The best refill added bonus offers a higher match up portion in addition to a huge optimum reward sum, along with sensible betting requirements. This Particular sort of reward is usually developed in order to incentive existing players with regard to making additional debris at the particular online casino, providing a useful bonus to become in a position to carry on playing and replenishing their own bank roll. Past the particular video games, ZetCasino seasonings items upwards together with competing tournaments, wherever gamers may climb leaderboards in inclusion to win huge.

Slot Machine Games Gallery Online Casino: Thirty Freispiele Ohne Einzahlung

Participants can perform using CAD, PLN, JPY, EUR, CNY, RUB, TRY, NOK, SEK plus HUF. When this particular details adjustments, we will be certain to upgrade this particular post. This on range casino makes use of a situation associated with the fine art SSL security software which usually guarantees that will all of the data you have joined is protected whatsoever times.

Faqs About No Down Payment Additional Bonuses

- These bonus deals are ideal when a person are a crypto gamer searching to maximize deposits.

- The wide selection of online games eligible with consider to the totally free spins guarantees that participants have got plenty of alternatives in order to take satisfaction in.

- Profits coming from typically the Totally Free Moves usually are subject matter to end up being in a position to a 50x wagering need.

- Furthermore, we all created a blog article about 13 No Downpayment Reward Misconceptions Every Gambler Ought To Realize.

- When a person need to learn more about this particular on range casino, please examine out there the review associated with Wi…

However, gambling websites just like Zet casino are usually using such problems head-on. Rather of shying apart through established casino businesses, they are coming upwards with increased techniques to win clients. Regarding occasion, Zet online casino is making use of various additional bonuses and marketing promotions to entice bettors. But very first, you possess in buy to go through a understanding curve regarding acquiring typically the benefits. More, you may finish upwards implementing methods that will typically the user will expression as deceitful and deny an individual the offer you or also close your bank account.

Contrasting No-deposit Totally Free Spins Vs Free Chips Additional Bonuses

Your Current totally free spins won’t last eternally, therefore pay close focus to become capable to typically the promotion’s validity period, at a similar time. A Few casinos simply offer a person seventy two hrs to become in a position to make use of your spins and meet typically the gambling specifications – skip the particular deadline day, in inclusion to you’ll surrender typically the added bonus. Constantly examine the spin and rewrite value, gambling needs in inclusion to maximum-win cap about your current free of charge spins – actually 12 FS can become well worth more compared to 3 hundred FS.

Can I Claim Zetcasino Totally Free Spins?

These Types Of a added bonus could get pretty a little bit of moment to obvious, especially in case the qualified games have got a lesser payout possible. Reload free spins are one more frequent prize that on the internet internet casinos provide to gamers who else help to make deposits. It’s the casino’s way associated with stating thanks to lively gamers in addition to motivating them to be in a position to maintain actively playing. Super Spins are high-value spins together with a significantly increased bet benefit each rewrite, usually about C$1.seventy seven or more, in contrast to common spins. They’re developed in purchase to provide a person a photo at bigger earnings in add-on to are generally part of specific marketing promotions or rewards.

- Need To an individual win something from the particular free bet, the bet sum will not necessarily be included inside your own winnings.

- Throughout enrollment, players may possibly end upward being needed to offer fundamental private details plus confirm their particular personality along with appropriate documents.

- Regular trips create it feasible in purchase to improvement through various loyalty levels, which automatically incentive high quality.

- It’s upward to an individual to be in a position to make sure on-line wagering is usually legal within your area in inclusion to in purchase to adhere to your own nearby restrictions.

Usually Are Zero Down Payment Bonus Deals Available To Be In A Position To All Players?

This Specific implies of which exactly what you win will be your own in purchase to maintain, without having needing more playthrough. These Types Of gives are usually uncommon plus usually component regarding exclusive promotions or benefits with respect to specific actions, just like producing a first downpayment or engaging in unique events. In Addition, it’s among the particular top-recommended online internet casinos within the particular field. A Curaçao-issued Internet video gaming permit will be applied by simply Zet Online Casino in order to run the on-line, survive supplier, in inclusion to mobile casinos. Considering That Zet Casino makes use of typically the newest security technologies to become in a position to safeguard gamer info, enjoying there’s safe and protected. People serious within the particular no money, win real cash method require to realize that will this particular will be possible.

By Simply participating inside loyalty applications, a person may add actually even more benefit to your on line casino added bonus and boost your current total gaming knowledge. Help To Make sure in buy to examine the phrases and circumstances of the loyalty system to end upward being capable to make sure you’re getting typically the many out there regarding your current details and advantages. A Person could likewise verify client evaluations on different online forums in inclusion to social networking platforms. By evaluating the particular on-line casino’s popularity, you could ensure that you’re selecting a bonus from a trusted operator, allowing an individual to enjoy your current gaming knowledge with peacefulness associated with mind.

In this specific circumstance, the particular commissions we may get regarding marketing typically the brand names offers not affected the particular ratings. Before you enjoy at any on collection casino, check if it is usually legal inside your own country. General, while checking out Zet On Collection Casino, we couldn’t discover any major problems or obstacles to complain about. In Case an individual pick not necessarily to use the particular ZetCasino reward code, or neglect in order to carry out thus, a person will continue to qualify for typically the common pleasant offer you. Typically The highest amount a participant could withdraw each month is usually $, however, VERY IMPORTANT PERSONEL participants can negotiate higher limitations along with the managers.

- Gamers favor pleasant free spins zero down payment since they allow these people to become capable to expand playing period right after the particular initial down payment.

- Picking a simply no downpayment added bonus online casino regarding South Africa inside 2025 that’s well worth it is more complex compared to you’ve possibly considered.

- These Sorts Of special offers are well-liked among players as they reward continuous devotion and increase gaming amusement.

- Zet Casino provides modified all the amusement regarding iOS/Android/Windows-based devices.

As the name indicates, consumers will obtain the choice in purchase to place a bet upon some thing free of charge regarding cost. Typically The amount depends on typically the user, in addition to each and every site provides the particular circumstances. Also whenever you’ve completed your current free of charge spins treatment, several operators will established a reduce on your current bet size although an individual continue to have got reward cash inside your bank account. A Great Deal More usually compared to not really, the particular reduce is repaired at £5 plus indicates a person can’t gamble more compared to this in the course of the wagering period of time. Given That it was founded over a 12 months in the past, Zet Casino is a brand name fresh, relaxing online online casino of which has recognized specifically just what players need plus it offers provided it to these people.

20 Free Of Charge Spins At Zet Online Casino

- July 14th, 2025

Also although right today there are simply no betting specifications, presently there usually are continue to strings attached. In many situations, the particular earnings are usually capped to little amounts in order to guarantee players won’t simply get their particular winnings plus keep. Regardless Of all regarding this, typically the zero gambling twenty free spin offers are nevertheless really worth claiming, as they offer you immediate accessibility to your own winnings. In Case an individual want a a lot more real-life experience, hop over to become in a position to typically the Zet Online Casino reside casino, exactly where an individual could enjoy typically the finest live supplier video games with professional dealers.

Could I Take Satisfaction In Playing Upon The Go?

- Zet Casino does provide a few regular promotions, but they will are usually a lot more regarding the particular competitions.

- Zet Online On Range Casino has a lookup functionality an individual can employ in case a person are usually looking regarding particular online games.

- This campaign will be a good superb approach in purchase to commence your current on range casino journey plus explore a broad range regarding slot equipment games.

- When an individual sign inside daily plus play survive dealer online games, a person likewise meet the criteria to receive upwards to be in a position to one hundred totally free spins.

- An Additional added bonus area regarding typically the betting system is usually released by typically the sports activities segment, where 1 may expect the particular following perks.

I didn’t think it has been thus good anywhere else a person would certainly have just credited the particular totally free spins. Therefore the particular on range casino by itself matches previously support will be expandable a person may attempt the particular on line casino in any case. Zet Casino’s user friendly interface tends to make navigation a piece of cake, whether you’re enjoying on pc or cell phone. Typically The responsive design adapts easily to different display screen sizes, allowing with regard to a great uninterrupted gaming knowledge about the particular proceed.

- To Become In A Position To top it off, the online casino games at Zet On Range Casino are totally HTML5 all set, so cell phone and pc gamers are all were made regarding; presently there is a good superb welcome bonus in addition to plenty regarding help alternatives.

- In Case you need in order to get typically the real on range casino experience, then Reside On Range Casino will be wherever it’s at.

- Consumers will also pay interest to typically the screensavers of slot machine devices, slot machines plus live games.

- As a aspect take note, typically the FREQUENTLY ASKED QUESTIONS segment is arguably the particular poorest we’ve seen inside our years associated with creating evaluations.

- All Of Us earned’t invest any kind of even more time in inclusion to will proceed above the particular needs due to the fact this specific will be a fantastic incentive.

ZetCasino offers flawless customer support that stands by their consumers. Cashout period is listed as twenty four hours for most transaction methods plus they will offer you a variety regarding fast banking options all of us will discuss within a devoted section. Has a portfolio of which functions eleven separate online on line casino jobs. In Case a person would like quick gratification, Zet Casino gives scratch playing cards plus accident video games.

Information Regarding 20 Free Spins Simply No Down Payment

Zet Casino is a protected on-line casino that you can constantly rely upon. Furthermore, an individual could rest assured regarding obtaining normal promotions. Live online games permit an individual in purchase to experience the particular atmosphere regarding a genuine online casino inside your home. Additionally, an individual obtain a chance in purchase to perform towards online casino reside sellers and your own other gamers.

Zet On Line Casino provides reliable plus strong customer assistance close to the particular time. Finally, a survive talk function on the particular cell phone version allows you talk together with consumer help when a person ever require aid. Inside unusual cases, you may need in purchase to make use of Zet Casino bonus codes to declare these gives.

- As part regarding this specific ZetCasino on range casino evaluation North america, all of us analyzed the particular system about different mobile gadgets.

- The casino processes some payments inside twenty four hours yet needs upwards to be capable to Seven company days and nights with consider to other folks.

- The on line casino desires to produce an superb gaming atmosphere and consequently offers a high-quality video gaming library therefore that will every gamer may find exactly exactly what he wants!

- The team associated with professionals have been reviewing on-line casinos, bonus deals, payment methods, plus online casino video games considering that 2011 to supply participants all above typically the planet with precise and dependable information.

Zet Online Casino: Ultimate Judgement

A Person can pick the particular a single that will fits an individual best or get component inside a lot more compared to 1 regarding the particular numerous continuous tournaments. Each And Every tournament’s description contains particulars regarding the particular rules plus regulations. Properly, each right now plus then the particular online casino will have got a questions where gamers may win awards simply with respect to enjoying. Let us break it down regarding you since it is actually simple in purchase to realize. Just as its name implies, this specific freebie is usually only available on Mon through Thursday regarding each and every few days. The Particular catch is usually that will a person possess to put straight down a moderate €20 down payment to become capable to acquire these sorts of delicious totally free spins.

Zet On Line Casino Transaction Plus Withdrawal Strategies

There’s just 1 reward circular, yet it’s collection-based, plus you can furthermore obtain numerous multipliers by getting wilds. Typically The RTP is previously mentioned typical, 96.71%, although typically the top reward is usually 4,000x the stake. You may get twenty free of charge spins on Large Largemouth bass Bonanza at Magic Red-colored On Line Casino. The Particular good information will be of which match up downpayment bonuses arrive with extremely reduced minimal downpayment sums. Manufacturers just like Movie stars casino in add-on to Sparkle Slot Device Games usually are ready to become capable to offer this specific provide with regard to players ready to end upward being able to spend £10 plus pick up typically the prize.

Zet On Range Casino Customer Support Dialects

You likewise could’t use this specific provide within conjunction with virtually any additional booster or sports activities bonus cash, which will be another restriction. If an individual need to end upwards being in a position to boost your earnings from successful wagers, use this particular offer to gamble upon groups of which you think will win along with two goals or even more. On One Other Hand, typically the name of typically the promotion will be a bit deceptive as a person may employ this specific bet on sporting activities additional than sports. Merely guarantee that a person down payment a lowest associated with €10 inside order to zet casino qualify with respect to the particular bonus given that it are not capable to be accumulated till this particular downpayment sum is usually met.

A Planet Associated With Strategy Along With Desk Online Games Plus Survive Dealers

To come to be qualified, a particular person must participate in the particular VERY IMPORTANT PERSONEL plan plus possess a single regarding typically the 3 leading statuses (Gamma, Delta, or Zet). The Particular supplied Zet On Collection Casino withdrawal procedures are secure in add-on to hassle-free. It is usually far better in order to select the exact same down payment and drawback choices in purchase to guarantee comfortable financial transactions. However, typically the maximal disengagement restrict depends about the particular VERY IMPORTANT PERSONEL status regarding a gamer.

Zet On Collection Casino Payment Options: Build Up Plus Withdrawals

Acquire a percent of your current loss returned in order to your accounts to keep on playing. Zet On Range Casino is quite a youthful online casino that has gathered the best online games associated with diverse genres. When an individual do not just like video slot machines, and then ZetCasino could offer several some other thrilling online online games, which often are usually offered in the appropriate areas. When all additional players have got obtained their spins, the last opportunities will become arranged. You’ll acquire to retain all associated with typically the cash that a person win throughout typically the tournament plus will also earn factors based about your current leaderboard placement, assuming you complete higher adequate. There’s a various reward to collect every few days at Zet Casino in add-on to there’s likewise a five-tier Commitment Plan.

- Participants usually are needed to create a deposit to claim these types of additional bonuses, nevertheless these people usually are often rewarded together with added benefits, like a combined downpayment added bonus.

- 108 Heroes is usually a typical Microgaming slot machine along with method movements plus a 96.56% RTP.

- They have furthermore manufactured area with regard to cryptocurrencies, which often usually are getting in significance in this contemporary age – Bitcoin, Litecoin, Ethereum in add-on to Ripple.

- When a person keep on to be a loyal client associated with typically the Zet Online Casino, after that presently there are nevertheless many great added bonus surprises waiting around with consider to an individual.

This Specific plan has some levels, which often a person development via by simply earning factors with consider to your current gameplay. As you perform so, your current rewards will increase within benefit, with perks including a a whole lot more appealing points trade rate, cashback, improved maximum withdrawal sums, plus your personal accounts manager. Typically The casino section of the particular special offers page at ZetCasino is usually exactly where an individual’ll locate all the site ‘s rewards, plus there are at present several on offer.

Check Out the Make Contact With Us page and you’ll locate a link to a FREQUENTLY ASKED QUESTIONS section that will answers most regarding the concerns that will usually are commonly asked simply by players. Right Now There are usually even more compared to twelve various repayment strategies an individual may make use of to end upward being in a position to help to make deposits to your own ZetCasino accounts. If you want in order to down payment Canadian bucks or some other traditional currencies your alternatives consist of VISA, MasterCard, Skrill, Neteller, PaySafeCard, Interac, MiFinity, ecoPayz, plus more. Your Own reward money will end upwards being credited just as the particular offer provides recently been triggered. Totally Free spins will be honored to an individual inside 12 daily batches of 20 free spins. ZetCasino isn’t typically the the vast majority of well-known gambling brand within the globe, nonetheless it provides recently been interesting gamers given that 2018 and includes a devoted subsequent.

Benefits And Cons Regarding Free Spins Additional Bonuses

All Of Us evaluation the overall T&Cs plus the 20 totally free spins zero down payment bonus conditions. After that will, we all may more thin straight down the listing of websites we all have got to overview in more fine detail. WatchMySpin gives fresh participants a 100% 1st down payment bonus upward in buy to £200 and something such as 20 totally free spins upon the Publication associated with Deceased slot machine game. Downpayment £20 in addition to get something just like 20 totally free spins upon Reactoonz slot machine online game – Zero Gambling Specifications. Make Use Of the promo code Q8805 any time lodging in buy to stimulate this specific offer you.

Possess a very good moment enjoying, but maintain within thoughts that typically the funds benefits will end up being honored simply in order to the maximum termes conseillés. Together With no restrict, an individual are usually free to become capable to claim an endless quantity regarding these sorts of rewards. These Types Of distinctive additional bonuses can end upward being employed by simply gamers who else create large debris and gamble big, which usually is extremely cool, inside the thoughts and opinions. Next, each Fri will be Royal Black jack, with the similar rules as typically the additional bonuses. In Blackjack Golf Club Royale, virtually any mixture regarding Queen and K – QQ, KK, QK, or KQ – may possibly earn you €10.

Zetcasino Evaluation Inside 2025 Enjoy Together With A 500 Pleasant Reward Confirmed

- July 14th, 2025

The Particular support mentioned these people could’t recover the free spins because I produced… It required confirmation as other internet sites but it doesnt consider long.Common amount associated with video games in add-on to pleasant offer you. Gambling not the particular lowest on the particular market didnt wager all of it so couldnt make a payout cant comment upon typically the procedure though. Typically The site was simply typical I was in a position to https://zet-casino-ca.com enjoy without having any errors or relationship… An Individual may perform this inside a amount of methods, including the the vast majority of protected and trusted transaction methods.

Zet On Line Casino Faqs

An Individual don’t need substantial online gambling encounter to become capable to state the ZetCasino becoming an associate of offer. Following you produce a great accounts following our own instructions in inclusion to help to make a being approved downpayment, you’ll turn out to be entitled in buy to declare typically the opening offer composed of a deposit bonus and totally free spins. This Particular package is free of charge coming from any low cost codes, that means an individual could immediately trigger it as soon as your current deposit moves through. It features a simple 5-reel, 3-row setting with ten paylines in inclusion to extremely couple of specific functions but a good 96.1% RTP and a maximum win regarding 500x. However, it offers repeated is victorious, in inclusion to together along with the broadening wilds of which result in respins, it’s no shock that will it provides become one associated with the many well-liked slots ever before.

- Players may access games, downpayment funds, in addition to declare promotions easily upon the two Android and iOS gadgets.

- The welcome offer you with regard to brand new participants at ZetCasino is usually a 100% added bonus of upwards to be able to $750 about your first deposit.

- When you’re really aesthetic and all about typically the consumer encounter, ZetCasino is usually certainly regarding a person.

- Araxio Advancement owns plus works Zet On Line Casino, which often very first opened up its doors inside 2018.

- Merely keep in mind the particular fact of which this specific promotional is accessible to single, numerous, in inclusion to program wagers placed upon typically the 1×2 part; these types of bet types are usually pointed out along with “ONLY” following to their particular names.

Enjoy £10, Obtain £30 On Bingo + One Hundred Totally Free Spins!*

- About a few years back, any time testing these types of varieties associated with additional bonuses, we all did not necessarily notice this particular deal along with simply 1x betting often.

- In Case you have got this problem also, after that a person require to become able to end reading through this specific review in order to the particular conclusion, since it will inform an individual about one associated with the particular the majority of well-liked internet casinos within 2020.

- Zet Casino encourages fresh gamers to become capable to claim a 100% Delightful Added Bonus up in buy to C$750 along with 200 Free Of Charge Moves in addition to 1 Reward Crab upon their particular 1st down payment.

- Like many on the internet casinos, ZetCasino provides gamers the opportunity to claim a welcome reward, for example a zero downpayment added bonus or a down payment added bonus.

- For numerous gamers, gambling specifications show to become typically the devil within the particular detail that will renders a great provide less worthwhile compared to it initially appeared.

- A Person usually do not require to become in a position to install virtually any added application in order to acquire started out and play.

We haven’t recently been able to end upwards being able to locate something just like 20 free of charge spins about Gonzo’s Pursuit together with simply no downpayment needed, but we all have other free spin and rewrite offers regarding the particular Gonzo’s Mission slot machine. A Few casinos, such as Netbet, demand a person to become able to verify your current telephone quantity just before declaring a reward. These Sorts Of mobile on collection casino totally free spins provides usually are not just like something like 20 FS upon card registration advertisements, as this particular will be usually a standard component of typically the casino’s KYC method. A Person sign up at a on line casino in add-on to receive the added bonus spins instantly afterwards. You’re not really necessary to end up being in a position to create a down payment, yet within many situations, the particular spins must be used upon particular slot device games, in add-on to presently there is a period restrict to end upward being capable to use them all (typically a week).

- Several online games like Joker Affect possess a increased RTP, at 98.11%, which indicates that will for each €100 secured, €98.11 should return to become able to gamers.

- The Particular web site provides links to become capable to reliable support companies regarding those who may need help with gambling-related concerns.

- Click On on typically the same named key at the particular left part regarding every web page in order to begin typically the chat.

- You will locate of which right right now there usually are above a few,000 online casino online games coming from zero fewer as in comparison to forty application companies, plus these varieties of amounts continue to grow.

We never had this concern ourself, nevertheless dependent upon typically the pure volume of these varieties of reports, it appears to be capable to become an important trouble. However, as mentioned inside our own Zet Online Casino Bonuses area over, obligations manufactured by means of these net wallets will not really qualify for the casino’s Pleasant Added Bonus. On Another Hand, right today there are a pair of caveats plus these sorts of require to be in a position to be regarded prior to a person declare your own bonus and go any kind of additional. Certificate, which usually is issued by simply the particular Curacao federal government, although all sport RNGs proceed by indicates of the particular TST (Technical Techniques Testing) for justness in inclusion to ethics.

Deposit Procedures, Processing Occasions & Downpayment Limitations

An Individual don’t possess in buy to down payment nevertheless must fulfil typically the card confirmation requirement by simply supplying a appropriate debit cards. Typically The greatest extent amount you could win from ten spins will be £8, that means an individual could win only £16. After That an individual need in purchase to wager typically the profits 65x (real money bets don’t count), right after which usually an individual could win upward in order to £50. On One Other Hand, there’s a tiny capture of which could increase typically the profits limit; any time you down payment, the particular maximum win cover will boost the same to the placed sum, together with £250 getting typically the maximum.

How Does Zet Online Casino Consider Upward Versus Some Other On Range Casino Internet Sites

I was pleased along with typically the presence regarding a filtration by providers plus a lookup club. Likewise, all games inside ZetCasino are usually easily split in to groups. Simply By the method, I saw several progressive slot machines right here of which will permit you to hit actually a lot more rewarding earnings. In Buy To get involved within procuring with respect to on the internet slots, an individual require to be at minimum typically the 3 rd stage in the particular site’s loyalty program. Account your current gaming bank account coming from Mon to Thursday Night in add-on to obtain fifty spins inside top online games regarding build up above C320. Prior To betting within a great online casino, you ought to carefully research what pitfalls are right here.

Does Zetcasino Possess A Lowest Withdrawal Amount?

Presently There is a great impressively varied choice regarding Survive On Collection Casino online games that an individual may play here, coming from typical desk games to contemporary Game Show game titles. The Particular delightful provide for new gamers at ZetCasino will be a 100% reward associated with upward in order to $750 upon your current 1st downpayment. A Person can lookup regarding any kind of sport by its title or explore the particular available game titles by genre. An Individual could likewise filtration video games simply by provider, which is usually useful when you take place in buy to have got a preferred.

Online Games

Typically The program in add-on to all the particular video games are HTML5 cell phone improved, including all the games in add-on to survive dealer games., and these people take numerous overseas foreign currencies. Presently There is likewise a wide selection of on the internet slot machines plus reside on line casino video games of which help cryptocurrencies, plus an individual can spot sporting activities wagers making use of crypto. This Particular will be fairly in range along with the requirements at some associated with typically the finest online casinos, thus absolutely nothing out there of typically the regular. A few payment methods just like Skrill plus Neteller are excluded through getting the bonus. NetBet is usually providing something like 20 totally free spins about the particular Book associated with Deceased slot machine to each new gamer.

Clicking upon typically the casino providers group requires an individual to become capable to a webpage that will lists all accessible providers and exhibits several online games through each and every, which usually is usually convenient. This Specific segment includes a leaderboard together with a specific list regarding sporting activities that enable players to participate in tournaments and get their particular rewarding advantages. Instead of a conventional welcome added bonus, 1 could claim a 100% down payment complement inside the sports activities section. Thus, 1 can pick their favored sports activities type in inclusion to even bet on typically the occasion reside inside real in add-on to even virtual sports. Talk About it in the particular sign up form to become capable to acquire even more bonuses as a component regarding the delightful offer. The system will be delivered to become able to lifestyle by the most recent software program supplied simply by noted 80+ sport programmers, which usually guarantees both perfect procedure, gorgeous visuals in addition to mobile optimization.

ZetCasino is an exciting and modern online on collection casino fully licensed and regulated beneath typically the Anjouan eGaming Panel, making sure a safe and fair gaming atmosphere. Versatile LimitsZetCasino benefits the two everyday participants and higher rollers simply by providing flexible down payment in inclusion to withdrawal restrictions. These Types Of added bonus provides ensure of which Zet Casino remains to be competing plus interesting with regard to Canadian participants, providing continuous value in addition to enjoyment with consider to every single type associated with player. Zet On Line Casino gives a extensive variety associated with additional bonuses tailored regarding Canadian gamers, ensuring both newbies plus regulars possess a lot regarding opportunities in buy to enhance their own bankrolls.

If an individual need in order to get the 55 totally free spins about top regarding that, your deposit need to be at the very least C$75. Right Today There is a 35x gambling requirement about typically the downpayment in inclusion to bonus amount, plus a 40x gambling need about your winnings through the particular totally free spins. Free spins could become utilized about typically the well-liked Detective Bundle Of Money slot device game plus may end upward being discovered below the ‘My Additional Bonuses’ case in your user profile. Make positive a person use the particular spins inside one day associated with activation, because right after that will they will vanish.

Typically The gamers can entry in inclusion to perform all the video games of typically the on collection casino catalog at the cellular edition. The colour structure will be dark-colored and yellow-colored, in add-on to typically the software is usually a delightful show associated with typically the newest games in add-on to marketing provides. The Particular internet site speed will be above typical plus the particular registration method will be speedy in add-on to effortless. Every function regarding the particular on range casino is usually quickly available coming from the house page and all typically the hyperlinks are quickly navigable. Araxio Growth has and operates Zet Casino, which often first opened up the doorways inside 2018.

Clear ProcessingThe online casino offers clear details upon running times, fees (if any), and limits, therefore presently there usually are no amazed. Get Into your own registered email deal with plus password within typically the individual areas. In Case you’re logging in regarding typically the 1st time, a person may be motivated to end up being able to verify your bank account by way of a code delivered to end upward being able to your email. This Particular extra action allows guard your own accounts plus individual details. We All possess examined several really comparable internet sites, which includes Rabona Sportsbook in inclusion to Online Casino, which often is usually worth a look if an individual just like this specific one. It will be 1 of the private favorite crypto sportsbook plus online casino mixtures.

The Particular slot machines collection spans through fruity-themed timeless classics to become in a position to contemporary marvels boasting 5 fishing reels and THREE DIMENSIONAL visuals, providing a soft changeover with regard to all those seeking variety. In Case you need to understand what otherwise it provides to become capable to offer you, study upon for our total ZetCasino overview. You should study typically the guidelines regarding eligibility for diverse sports in buy to find out any time and exactly how very much an individual can obtain. Zet Casino utilizes 128-bit SSL encryption technological innovation plus the particular latest edition regarding the particular TLS protocol in buy to ensure typically the strict confidentiality associated with customer info plus funds. It sticks to to be able to the particular license regulations of Curacao plus Antillephone in addition to ensures typically the complete safety associated with the consumers.

You should believe thoroughly about how a lot to bet in addition to get advantage associated with dependable wagering resources like downpayment plus time restrictions online casinos offer. A free spins, no-deposit bonus may come in the form of a welcome added bonus with regard to brand new gamers or even a promo with respect to a great existing client. As typically the name implies, an individual don’t need to put money to become in a position to your current accounts in purchase to access these totally free spins. A Person might also encounter Canadian internet casinos that provide $5 downpayment bonus deals, allowing you in buy to declare a pleasant provide together with minimum investment decision. Some operators may possibly even offer you a no-deposit offer, meaning you don’t need in buy to help to make a deposit in order to accessibility the promotion.

When I had been placing your signature to up for Zet Online Casino, I discovered the process fairly easy. It is usually really worth remembering that SSL security software program shields all private data at the online casino. Although some people like betting on horses races, this particular is usually certainly not really typically the circumstance with regard to typically the huge the better part of gamers. In Inclusion To however, ZetCasino will become seeking to match up your current bet regarding 50% upwards to €50, yet only regarding shedding bets. Typically The Zet On Collection Casino 12 Free Of Charge Rotates can end upward being redeemed by simply signing in to your accounts, browsing through to the “Promotions” tabs, and deciding directly into typically the offer you.

Similar On Range Casino Suppliers

If an individual help to make it to end up being in a position to the greatest levels, a person may negotiate even larger drawback restrictions, or at the really least that’s exactly what the particular VIP page statements. Typically The client assistance staff at Zet Online Casino is usually operational 24/7 via survive conversation, telephone, in inclusion to e-mail. Whenever we all logged on to in inclusion to examined the particular reside conversation, we identified that the particular customer help at Zet Online Casino will be extremely receptive plus trustworthy. Furthermore, if you want to call the particular online casino, right right now there usually are a number of mobile phone amounts outlined inside the particular ‘contact’ section, which often a person can discover the link to become capable to this web page inside the footer. Zet Online Casino is a moderately established cellular casino, and so it makes use of HTML5 technologies with consider to their complete system.

Mother your children are like birds

- July 14th, 2025 by Chris Turner

- from Vancouver (British Columbia, Canada)

Mother, your children are like birds,

Their wings have fluttered into the distance.

Mother, to the bright and native chamber,

Soon we shall return once more.