20 Bet Nasz Kraj ️ Oficjalna Witryna

Najpopularniejszą formą łączności z supportem wydaje się czat na żywo, który widnieje w prawym dolnym rogu strony. Riposty na nurtujące nas zapytania można odnaleźć także w obszernym FAQ. Ponadto funkcjonuje możliwość kontaktu telefonicznego zbyt pomocą szczegółowego e-maila, jednakże korzystając wraz z tejże opcji, trzeba liczyć się wraz z dłuższym czasem na odpowiedź. 20Bet jest to względnie nowa marka, gdyż na sektor weszła przed chwilą w 2018roku. Od Momentu owego okresu zdążyła wyrobić sobie dobrą renomę wśród miłośników tytułów losowych. Serwis może pochwalić się nieczęsto spotykaną w teraźniejszych epokach wszechstronnością.

Przebieg Rejestracji Nieznanego Konta Bankowego Użytkownika

- Do Odwiedzenia obstawiania należy nam przeciętnej jakości aparat telefoniczny wraz z Androidem albo IOS i płynny dostęp do internetu.

- Oprócz tegoż można obstawiać drużynę, która strzeli następną bramkę, na wstępie i ostatnie napomnienie, termin, gdy padnie główna bramka itd.

- Bez względu na owo, gdzie mieszkasz, w 20Bet wyszukasz swe ulubione dziedziny sportowe.

- Wypłaty wygranych są wyjątkowo nieskomplikowane – trzeba przejść do własnego opisie i działu wraz z płatności, wybrać opcję „Wypłata”, a następnie postępować według wskazówek pojawiających się na monitorze.

- Dzięki propozycji przeszło 2000 różnorodnych tytułów w żadnym wypadku się tu nie zaakceptować nudziłem.

Jeśli rozchodzi o listę dostępnych do obstawiania dyscyplin sportowych, 20Bet zdecydowanie NIE zawodzi. W Czasie pisania tego artykułu jest to więcej niż 40 różny sportów do obstawiania i przeszło 2000 opcji obrócenia zakładów. Sprawdź śmiało na stronie www głównej, bądź Twe ulubione sporty są w tym miejscu uwzględnione. O legalne świadczenie usług hazardowych dba licencja wydana przez rząd Curacao. Gwoli wszystkich internautów hazardowych i fanów zakładów bukmacherskich przygotowano mnóstwo możliwości do wybrania, a także hojne bonusy, ułatwiające zapoznanie się z ofertą operatora. Nie, ale są więcej efektywne metody na połączenie z zespołem obsługi kontrahenta.

Metody Wypłaty 20bet

Istnieje dużo różnych sposobów, żeby skontaktować się z obsługą kontrahenta. Najszybszym rodzajem skontaktowania się spośród nimi jest napisanie wiadomości na czacie na żywo. Alternatywnie, możesz wysłać e-mail na adres bądź wypełnić blankiet kontaktowy na stronie internetowej. Wszystkie promocje obok tego operatora posiadają swój regulamin, gdzie można dowiedzieć się więcej o naszym, jakie są warunki ruchu, minimalna wpłata i inne.

Aplikacja 20bet – Urządzenia Ios

Możesz obstawiać tego rodzaju zabawy jak Overwatch, Dota dwóch, Counter Strike, League of Legends i parę odmiennych. Operator posiada licencję na oferowanie usług hazardowych wydaną poprzez Curacao e-gaming. Znaczy to, że portal ten działa prawnie w wielu państwach Europy i świata. Każdy zainteresowany fan może postawić swój zakład na ulubioną dyscyplinę sportową bądź e-sportową, lub sprawdzić się w grach na automaty, grach stołowych i tych spośród prawdziwym krupierem na żywo.

- Sprawdziliśmy też możliwości wygranej i cały system wpłat oraz wypłat.

- Na uwagę zasługuje hojna oferta bonusów i ofert na rzecz wszelkich użytkowników, wygodne i bezpieczne kształty płatności a także przychylna obsługa konsumenta.

- Wszyscy zawodnicy mogą skorzystać z identycznej możności wypłaty, która została wybrana do wpłaty depozytu.

- Wszelkie rozrywki są dostępne w dwóch opcjach – bezpłatnej gry oraz rozrywki za prawdziwe pieniądze.

Witryna Mobilna

Swój bonus od czasu depozytu można wybrać tuż przy zakładaniu konta bankowego gracza i zdecydować, czy ma mężczyzna być nadany na zakłady sportowe, czy grę w kasynie internetowego. Dziś w ofercie kasyna i zakładów bukmacherskich nie zaakceptować wydaje się być dostępny nadprogram wyjąwszy depozytu, aczkolwiek zawodnicy mogą uzyskać interesujące bonusy według poczynieniu krytycznej wpłaty. 20Bet casino i zakłady bukmacherskie jest to dobre obszar w necie, w którym miłośnicy hazardu online mogą oddać się ulubionej znajomych.

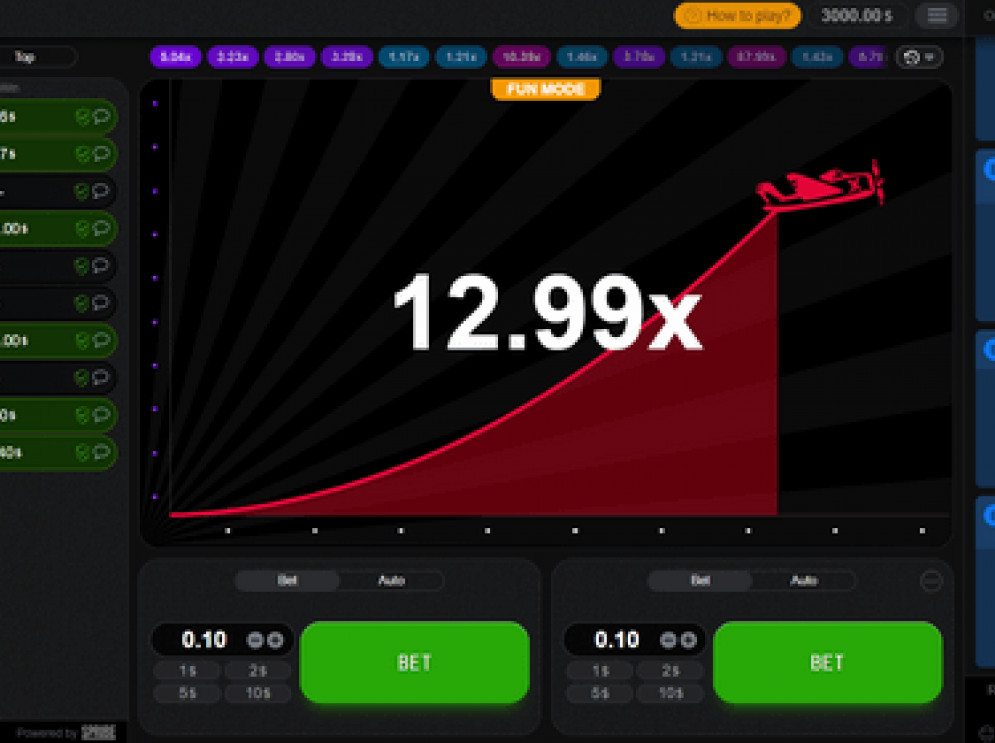

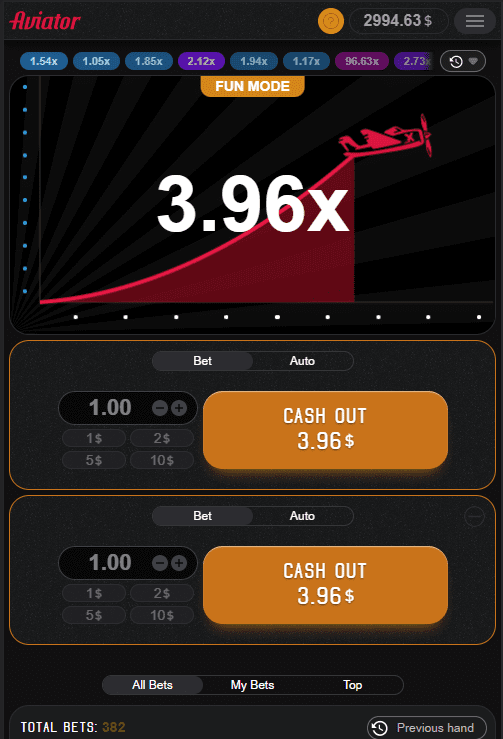

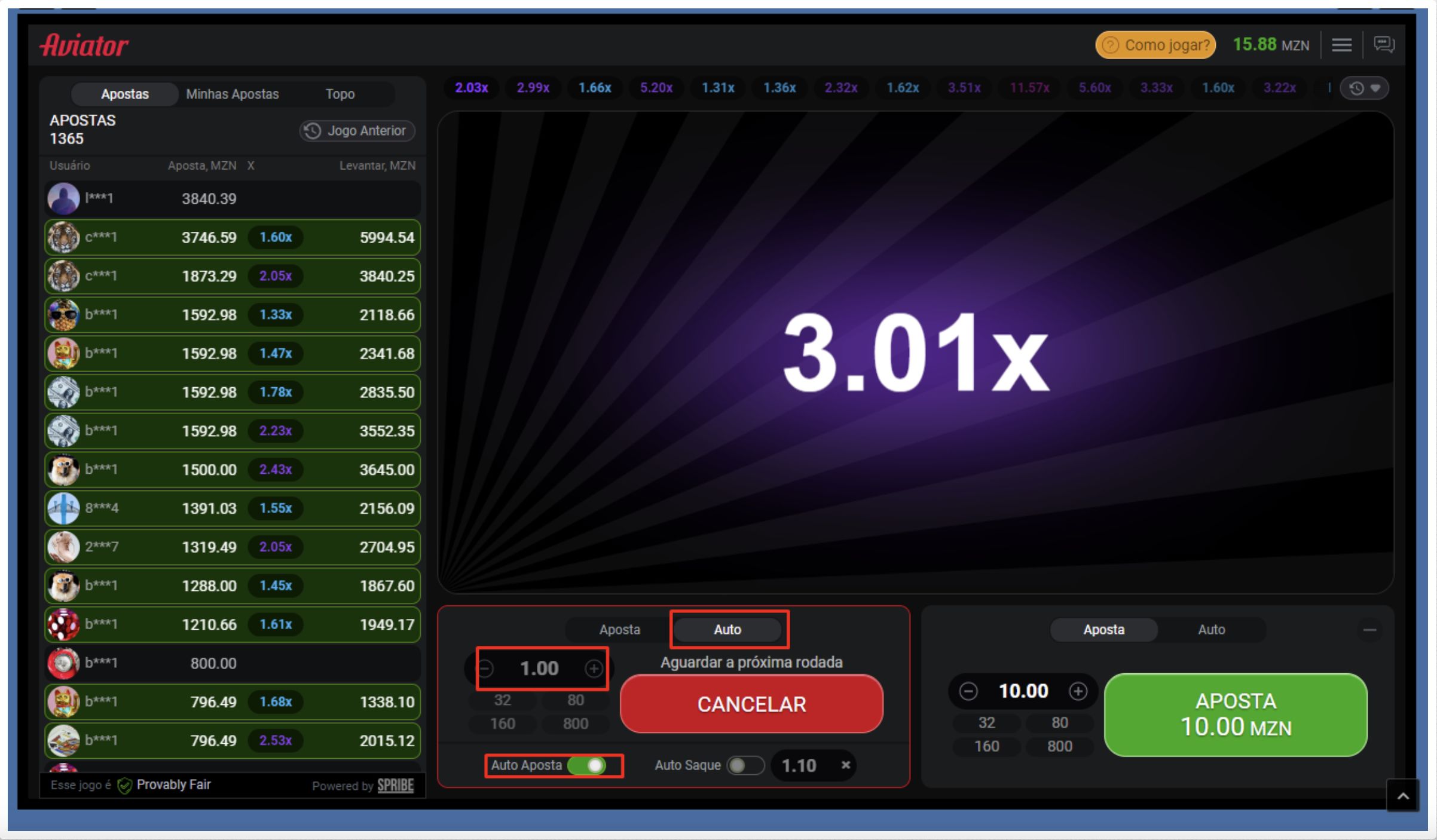

Jeśli chodzi o strefę bukmacherską, jest to tu wydarzenia live uaktywniają się, na rozpoczęciu danych empirycznych spotkań. Dzięki wstecz możemy je obstawiać w trakcie ich odbywania się, ze ciągle aktualizowanymi kursami. Jest to bardzo ciekawa odmiana gry, gdyż przysparza pani sporo emocji, a niepewność spowodowana ciągle zmieniającymi się mnożnikami, wyłącznie daje pikanterii. Aby jednakże ten gatunek rozgrywki miał rzeczywiście sens, powinno się wyczuć odpowiedni moment na wniesienie kuponu, toteż zakłady online są popularne głównie wśród więcej nowoczesnych typerów. Warto też pamiętać, że wzory i wyzwania jak do bonusów stanowią, że Twoje wygrane mają czterdziestokrotny wymóg gry. Jest To znaczy tak wiele, że każde bonusy, które zrealizujesz – muszą być obrócone chociaż 30 razy, nim będziesz w będzie wypłacić osiągnięte z wymienionych wygrane.

Bonus Powitalny

Obstawiający zakłady sportowe mogą uzyskać bonus powitalny 100% do 400 złotych za swój główny przechowanie w stronie internetowej 20Bet. W tym celu w czasie rejestracji żądane jest wybranie należytego bonusu. Następnie należy dokonać pierwszego depozytu o wartości co najmniej 30 złotych. Więcej szczegółów na temat bonusu wyszukuje się w kodeksie promocji. Z przyjemnością sprawdziliśmy dla Cię zakłady sportowe i kasyno 20Bet, ponieważ badanie bezpiecznych witryn internetowych w każdej sytuacji jest przyjemnością.

- Aby aczkolwiek ten rodzaj partii miał rzeczywiście sens, powinno się wyczuć właściwy moment na wniesienie kuponu, toteż zakłady internetowego są znane głównie wśród w wyższym stopniu nowoczesnych typerów.

- System szyfrowania danych empirycznych chroni każdą naszą transakcję i poufne wiadomości, więc możemy mieć pewność, że płatności będą dokonywane w sposób przejrzysty i natychmiastowy, bez zbędnej prowizji.

- Podczas Gdy grasz w 20Bet, możesz im zaufać, że priorytetowo potraktują Swoje bezpieczeństwo.

- Swój nadprogram od depozytu można wybrać przy zakładaniu konta bankowego gracza i zdecydować, bądź dzierży pan być nadany na zakłady sportowe, bądź grę w kasynie przez internet.

- Kasyno powstało w 2020 roku, a tej operatorem są ludzie wraz z uznanego TechSolutions, które dało się poznać jak rzetelna firma, której zaufało już sporo użytkowników.

- Bukmacher 20Bet wykorzystuje na swojej stronie www własną platformę do obsługiwania zakładów sportowych Soft-labs.

Należy, że założysz profil, wpłacisz 10$ albo więcej, a zdobędziesz do odwiedzenia 100$. Pozostałymi słowy, możesz wpłacić 100$ i otrzymać dodatkowe 100$, zwiększając swój forma konta bankowego do odwiedzenia 200$. Gdy pieniądze zostaną przelane na Twe rachunek rozliczeniowy, stawiaj zakłady na wydarzenia wraz z kursem jak najmniej 1.szóstej i obróć kwotę wpłaty jakie możliwości najmniej 5 razy. 20Bet bukmacher umożliwia obstawianie zakładów muzycznych przedmeczowych, innymi słowy ludzi najciekawszych, które obstawia się zanim rozpoczęciem meczu albo wyścigu. Tego Rodzaju zakłady mają dużo różnych możności do wyboru i trochę bardziej wartościowe warsztaty. Niestety, nie zaakceptować można zmienić własnych typów już po rozpoczęciu się wydarzenia.

Na przykład, możesz spróbować Mega Fortune Dreams i mieć szansę na wielką wygraną. Odmienne sloty, o których warto wspomnieć owo Viking Wilds, Fire Lightning i Dead or Alive. Wykorzystaj dzienne bezpłatne spiny, żeby grać w sloty wyjąwszy stawiania zakładów na prawdziwe pieniądze.

W poszukiwaniu pewnej strony hazardowej, wielu graczy szuka konkretnego portalu, który zaoferuje dywanom pełną ofertę rozrywki i dostępu do odwiedzenia różnorodnego hazardu online. Sprawy i płatności jest to 1-a spośród najważniejszych sekcji kasyn internetowego. Twórcy dali wiele możliwości wpłat oraz wypłat, więc każdy użytkownik powinien znaleźć gwoli siebie zaufaną i odpowiednią opcję.

W Jaki Sposób tylko Swoje dane zostaną sprawdzone, dostaniesz list elektroniczny spośród potwierdzeniem. Owo właśnie wówczas możesz się zalogować, dokonać własnej pierwszej wpłaty i odebrać każde bonusy. Możesz obstawiać zakłady podczas meczu sportowego i śledzić grę w momencie faktycznym. Wiadomości są aktualizowane online, więc upewnij się, że masz dobre połączenie z internetem, żeby zapewnić samemu niezakłócone wrażenia. Aby zakwalifikować się do odwiedzenia tego pliku powitalnego, możesz użyć dowolnej metody wpłaty, wraz z wyjątkiem przelewów kryptowalutowych. Pomijając naszym, możesz wybrać prawie każdy rodzaj zakładu i obstawiać na wiele dyscyplin sportowych jednocześnie.

Zawodnicy mogą także skorzystać spośród strony mobilnej wpisując adres 20bet.com w przeglądarce urządzenia. Opcje płatności w naszym kasynie nie zaakceptować pozostawiają wątpliwości, że operator zrobił całokształt, by ułatwić naszym użytkownikom dokonywanie szybkich depozytów i wypłat. Do Odwiedzenia wybrania są między odmiennymi karty płatnicze Mastercard i Visa, płatności spośród portfeli kryptowalutowych, vouchery paysafecard, MiFinity, eZeeWalet, Flexepin i odmienne 20bet. Chociażby początkujący gracze odrzucić będą mieć żadnych problemów spośród założeniem nieznanego konta bankowego w tym portalu. Także każde następne w 20Bet PL logowanie przeminie szybko i bez problemów, ponieważ wystarczy jedynie uruchomić szyba logowania, wpisać swój 20Bet login i hasło i zatwierdzić.

Premia powitalny od czasu krytycznej wpłaty.Gracze kasyna online mogą otrzymać nadprogram 100% krytycznej wpłaty do odwiedzenia pięć stów złotych i 120 bezpłatnych spinów do odwiedzenia automatu do odwiedzenia konsol Elvis Frog in Vegas. Żeby otrzymać nadprogram, należy zaznaczyć odpowiednią opcję bonusu w czasie zapisu oraz dokonać pierwszej wpłaty o wartości co najmniej 80 złotych. Darmowe spiny zostaną dodane do konta gracza na 30 spinów na dzień przez cztery kolejne dni. 20Bet jest to strona łaskawa dla urządzeń przenośnych, która odruchowo dopasowuje się do odwiedzenia mniejszych ekranów. Możesz korzystać wraz z dowolnego komórkowy z programem Mobilne bądź iOS, by uzyskać dostęp do stanu konta, grać w zabawy kasynowe i obstawiać zakłady.

Nawet jeśli odrzucić wydaje się owo wymagane w czasie procesu rejestracji konta bankowego przez internet, prawdopodobnie będzie, kiedy postanowisz wypłacić nagromadzone środki. Bukmacher sportowy 20Bet przygotował dla wszelkich świeżych internautów zauważalnie interesujące oferty tak zwanym. Bonusów na dzień porządny, zniżki cashbacku jak tydzień a także inne gratyfikacje do wykorzystania w wirtualnym kasyna, lecz i przy zawieraniu zakładów muzycznych.

Opcja ta może być interesująca głównie na rzecz użytkowników, którzy lubią interakcję z pozostałymi. Komunikować można się spośród innymi pasjonatami gier i zawierać interakcje chociażby spośród krupierem. Na systemie zawarte zostało więcej niż 300 różnych pozycji on-line, takowych jak bakarat lub ruletka, więc każdy z brakiem problemu odnajdzie się w kasynie.