Betano Casino Overview 2025 A Couple Of,900+ Casino Games

- July 6th, 2025

As typically the primary recruit associated with EPL team Aston Rental property and a spouse associated with UEFA’s Europa Little league in addition to Meeting Group, Betano provides strongly founded the existence inside the particular sports wagering globe. In Addition, movie poker enthusiasts can appreciate headings like Joker Holdem Poker and Deuces Crazy, which include selection to be in a position to the particular mix. Nevertheless, the lack regarding Slingo may possibly fail a few participants, as this specific straight has obtained considerable reputation in Europe lately. Six procedures are usually obtainable with regard to running withdrawals at Betano Online Casino in Ontario. The Particular speediest in inclusion to most easy payout method will be Interac e-Transfer, which provides you accessibility in purchase to your funds inside 30 moments, nevertheless effects may possibly differ.

Does Betano Casino Provide A Cell Phone App For Gambling Upon Typically The Go?

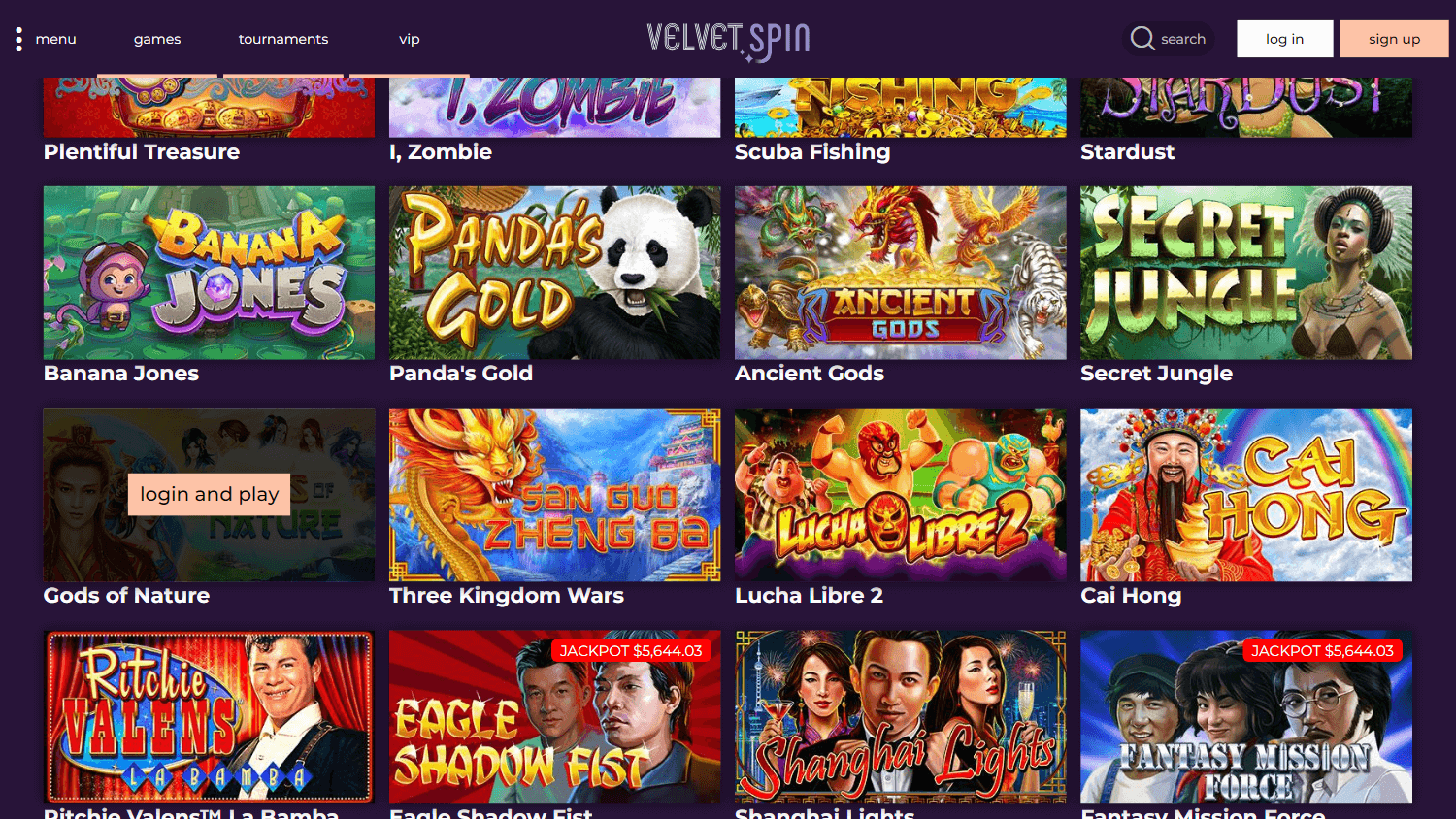

Within the Betano On Line Casino overview, all of us get a closer appearance at just what can make this platform a fantastic option for Ontario participants. Although Betano doesn’t offer you typically the biggest selection regarding classic stand online games in Ontario, it offers adequate variety in buy to fulfill the the greater part of participants. The casino functions several blackjack, different roulette games, and baccarat variants, catering in purchase to each high- in addition to low-stakes preferences.

Deposits & Withdrawals

In The Course Of the Betano Ontario review, we identified a good portion of reside casino game show headings, accompanied simply by a robust selection associated with survive seller table games. When you’re looking with consider to a mobile-first casino inside Ontario, get the particular Betano application regarding totally free in inclusion to enjoy countless numbers of slots, desk online games, in add-on to live dealer game titles directly upon your current smartphone or pill. Accredited simply by the particular Alcoholic beverages plus Gambling Percentage associated with Ontario (ACGO) and iGaming Ontario (iGO), Betano Online Casino is usually a trustworthy plus genuine on the internet on range casino choice for participants within Ontario. Right Today There are above a pair of,900 games, which includes slot machines, desk video games, plus survive dealer headings, together with a specifically amazing assortment regarding jackpot feature slot machines for large prospective payouts. Both the particular desktop computer encounter and mobile software are usually top-notch in add-on to one of typically the finest components concerning this particular Ontario on the internet on range casino.

Betano On Collection Casino Review

This far exceeds typically the game choices at many additional well-known Ontario gambling sites, which usually typically offer you much less than 1,000 games. Free Of Charge professional educational classes for on-line online casino workers aimed at market greatest practices, enhancing player knowledge, and reasonable method to wagering. Betano is licensed simply by the particular ACGO plus iGO, enabling it to operate lawfully inside Ontario.

- Betano Online Casino gives 7 convenient methods with respect to adding cash to become capable to your account in Ontario.

- Free specialist educational courses regarding on the internet casino staff targeted at industry finest procedures, enhancing gamer knowledge, and reasonable method to wagering.

- Licensed by simply the Alcohol consumption in inclusion to Gambling Commission of Ontario (ACGO) and iGaming Ontario (iGO), Betano Online Casino is usually a trustworthy and reputable on-line on collection casino alternative for gamers inside Ontario.

- The quickest plus the vast majority of convenient payout approach will be Interac e-Transfer, which offers a person entry to your cash within 30 moments, but effects might fluctuate.

Downpayment Options

Betano provides combined along with several business leading galleries in order to offer exclusive game titles that can’t become identified anyplace else within Ontario. Interac e-Transfer plus PayPal affiliate payouts are prepared quickly by simply Betano plus need to show in your current account within a few hours within many instances. What’s more, presently there are zero costs linked to withdrawals, so you acquire in buy to maintain all of your winnings.

Exactly What Protection Actions Does Betano Online Casino Use To End Upward Being In A Position To Guard Our Personal And Financial Information?

All transaction strategies are free of charge of digesting fees, in addition to deposits usually are awarded in purchase to your bank account immediately. Furthermore, Betano includes a comparatively high highest down payment reduce, enabling you to end upwards being in a position to include upward to be in a position to $50,000 by way of a charge or credit rating cards with out contacting consumer support. A platform produced to showcase all of our initiatives aimed at delivering the perspective associated with a safer plus even more clear online gambling market to become in a position to actuality. The Particular site will be accredited plus controlled within Ontario simply by typically the ACGO plus iGO, the pays recognized betting regulators. This Particular assures that Betano sticks to become able to typically the stringent suggestions with consider to workers, protecting participants in inclusion to offering alternative should any type of issue come up.

To End Upward Being Capable To sign-up for an bank account at Betano On Collection Casino, an individual must be 19 or older in add-on to dependent within Ontario. Stick To the particular requests in purchase to produce your own accounts just before proceeding to be able to typically the cashier to betanoro.com create your own very first deposit.

Unique Online Games

It will be also a global casino in inclusion to sportsbook, with permit inside other main jurisdictions, including typically the Usa Kingdom. Along With countless numbers of slot machines, dozens of RNG stand games, and loads of survive seller video games, there’s something with respect to every person at Betano. A Great initiative all of us launched together with the objective to be able to create a global self-exclusion system, which often will allow prone gamers to obstruct their particular access to all on-line betting opportunities. In Case an individual’re browsing regarding a top-rated on-line on range casino and sportsbook within Ontario, Betano will be well really worth contemplating. Throughout the Betano Casino evaluation, we all had been amazed by simply typically the software’s soft navigation, considerable online game choice, in addition to typically the capability to end upward being capable to contact customer help directly.

- Each the particular pc knowledge and cellular application are top-notch plus a single associated with the finest elements regarding this specific Ontario on-line on collection casino.

- Working inside just before accessing live conversation is usually suggested to aid the support group quickly identify your concern.

- The Particular assistance team’s speedy reply occasions make sure virtually any issues are usually solved efficiently.

- Interac will be the particular most well-known selection among Canadians, but additional choices like Apple Spend, debit playing cards, and PayPal are usually furthermore backed.

- Additionally, video clip poker lovers could take enjoyment in headings like Joker Holdem Poker in add-on to Deuces Wild, which often add variety in buy to typically the mix.

Inside inclusion to standard sporting activities, Betano gives market segments regarding Esports plus virtual sports activities, allowing a person to bet upon the particular actions close to the particular clock, even when zero reside sports fixtures are obtainable. Betano Casino’s website features site-wide SSL encryption to end upward being able to safeguard your private and economic details. Furthermore, the internet site keeps SecureTrust certification, displaying Betano’s standing being a reliable program. A Person may look at the SecureTrust certificate by simply clicking typically the tabs at typically the bottom part of typically the Betano homepage. In Case you’re blessed adequate to win while actively playing at Betano On Range Casino inside Ontario, you may access your current winnings on the similar time.

The help team’s quick response occasions ensure any sort of problems are usually solved successfully. As each the particular conditions of Betano’s certificate, typically the web site providers must conform in buy to stringent plans in add-on to methods regarding participant safety, accountable betting, and clear gaming. Your private information is protected along with site-wide SSL security, in addition to typically the program is usually SecureTrust up to date, ensuring a safe plus reliable gaming surroundings.

An Individual may access typically the Betano Sportsbook along with the exact same information a person applied to acquire started at the particular online casino. For a lot more quick assistance, the particular Betano survive conversation will be available 24/7 through the software or typically the site homepage. Working in just before getting at live chat is recommended in order to help the particular assistance team rapidly determine your issue. Betano Sportsbook features a comprehensive variety regarding marketplaces plus gambling choices throughout football, sports, basketball, handbags, tennis, plus all other main sports activities.

Typically The major disadvantage identified in the course of the Betano Ontario review is the particular running moment regarding certain payout methods, which usually may take upwards to end upward being capable to five days and nights. The minimum downpayment is simply $5 any time using The apple company Spend or Google Spend, while all other procedures need a $10 minimal. This is one regarding the least expensive lowest debris we’ve noticed within the particular Ontario market, producing Betano an excellent place with consider to low-budget gamers. Betano On Collection Casino offers seven hassle-free strategies for adding funds to your account within Ontario. Interac will be the most popular choice among Canadians, nevertheless additional alternatives just like Apple company Pay, charge playing cards, plus PayPal are likewise supported. During our own evaluation, we all tested the particular reside conversation function, which often initially attached us in buy to a robot before transferring us to become in a position to a reside broker.

With above two,five hundred headings, Betano’s slot machine game catalogue features top-rated video games from top-tier companies such as Sensible Enjoy, Playtech, and Games International. Whether Or Not an individual favor Megaways, jackpot slot machines, or bonus buy games, you’ll locate powerful game play in addition to numerous earning options. The Particular evaluations usually are extremely optimistic upon each the Apple company and Google Perform Retailers, with participants pleased by typically the top quality associated with typically the application knowledge and the broad range of mobile-optimised online games. An Additional cause in buy to select Betano On Collection Casino above other wagering internet sites is their own impressive choice of above one hundred goldmine games. At the moment regarding the Betano On Collection Casino evaluation, we identified 128 jackpot feature slot equipment games, showcasing modern jackpots. Betano’s on-line online casino library consists of above two,nine hundred excellent games from many of companies.

Betano Casino Overview 2025 A Couple Of,900+ Casino Games

- July 6th, 2025

As typically the primary recruit associated with EPL team Aston Rental property and a spouse associated with UEFA’s Europa Little league in addition to Meeting Group, Betano provides strongly founded the existence inside the particular sports wagering globe. In Addition, movie poker enthusiasts can appreciate headings like Joker Holdem Poker and Deuces Crazy, which include selection to be in a position to the particular mix. Nevertheless, the lack regarding Slingo may possibly fail a few participants, as this specific straight has obtained considerable reputation in Europe lately. Six procedures are usually obtainable with regard to running withdrawals at Betano Online Casino in Ontario. The Particular speediest in inclusion to most easy payout method will be Interac e-Transfer, which provides you accessibility in purchase to your funds inside 30 moments, nevertheless effects may possibly differ.

Does Betano Casino Provide A Cell Phone App For Gambling Upon Typically The Go?

Within the Betano On Line Casino overview, all of us get a closer appearance at just what can make this platform a fantastic option for Ontario participants. Although Betano doesn’t offer you typically the biggest selection regarding classic stand online games in Ontario, it offers adequate variety in buy to fulfill the the greater part of participants. The casino functions several blackjack, different roulette games, and baccarat variants, catering in purchase to each high- in addition to low-stakes preferences.

Deposits & Withdrawals

In The Course Of the Betano Ontario review, we identified a good portion of reside casino game show headings, accompanied simply by a robust selection associated with survive seller table games. When you’re looking with consider to a mobile-first casino inside Ontario, get the particular Betano application regarding totally free in inclusion to enjoy countless numbers of slots, desk online games, in add-on to live dealer game titles directly upon your current smartphone or pill. Accredited simply by the particular Alcoholic beverages plus Gambling Percentage associated with Ontario (ACGO) and iGaming Ontario (iGO), Betano Online Casino is usually a trustworthy plus genuine on the internet on range casino choice for participants within Ontario. Right Today There are above a pair of,900 games, which includes slot machines, desk video games, plus survive dealer headings, together with a specifically amazing assortment regarding jackpot feature slot machines for large prospective payouts. Both the particular desktop computer encounter and mobile software are usually top-notch in add-on to one of typically the finest components concerning this particular Ontario on the internet on range casino.

Betano On Collection Casino Review

This far exceeds typically the game choices at many additional well-known Ontario gambling sites, which usually typically offer you much less than 1,000 games. Free Of Charge professional educational classes for on-line online casino workers aimed at market greatest practices, enhancing player knowledge, and reasonable method to wagering. Betano is licensed simply by the particular ACGO plus iGO, enabling it to operate lawfully inside Ontario.

- Betano Online Casino gives 7 convenient methods with respect to adding cash to become capable to your account in Ontario.

- Free specialist educational courses regarding on the internet casino staff targeted at industry finest procedures, enhancing gamer knowledge, and reasonable method to wagering.

- Licensed by simply the Alcohol consumption in inclusion to Gambling Commission of Ontario (ACGO) and iGaming Ontario (iGO), Betano Online Casino is usually a trustworthy and reputable on-line on collection casino alternative for gamers inside Ontario.

- The quickest plus the vast majority of convenient payout approach will be Interac e-Transfer, which offers a person entry to your cash within 30 moments, but effects might fluctuate.

Downpayment Options

Betano provides combined along with several business leading galleries in order to offer exclusive game titles that can’t become identified anyplace else within Ontario. Interac e-Transfer plus PayPal affiliate payouts are prepared quickly by simply Betano plus need to show in your current account within a few hours within many instances. What’s more, presently there are zero costs linked to withdrawals, so you acquire in buy to maintain all of your winnings.

Exactly What Protection Actions Does Betano Online Casino Use To End Upward Being In A Position To Guard Our Personal And Financial Information?

All transaction strategies are free of charge of digesting fees, in addition to deposits usually are awarded in purchase to your bank account immediately. Furthermore, Betano includes a comparatively high highest down payment reduce, enabling you to end upwards being in a position to include upward to be in a position to $50,000 by way of a charge or credit rating cards with out contacting consumer support. A platform produced to showcase all of our initiatives aimed at delivering the perspective associated with a safer plus even more clear online gambling market to become in a position to actuality. The Particular site will be accredited plus controlled within Ontario simply by typically the ACGO plus iGO, the pays recognized betting regulators. This Particular assures that Betano sticks to become able to typically the stringent suggestions with consider to workers, protecting participants in inclusion to offering alternative should any type of issue come up.

To End Upward Being Capable To sign-up for an bank account at Betano On Collection Casino, an individual must be 19 or older in add-on to dependent within Ontario. Stick To the particular requests in purchase to produce your own accounts just before proceeding to be able to typically the cashier to betanoro.com create your own very first deposit.

Unique Online Games

It will be also a global casino in inclusion to sportsbook, with permit inside other main jurisdictions, including typically the Usa Kingdom. Along With countless numbers of slot machines, dozens of RNG stand games, and loads of survive seller video games, there’s something with respect to every person at Betano. A Great initiative all of us launched together with the objective to be able to create a global self-exclusion system, which often will allow prone gamers to obstruct their particular access to all on-line betting opportunities. In Case an individual’re browsing regarding a top-rated on-line on range casino and sportsbook within Ontario, Betano will be well really worth contemplating. Throughout the Betano Casino evaluation, we all had been amazed by simply typically the software’s soft navigation, considerable online game choice, in addition to typically the capability to end upward being capable to contact customer help directly.

- Each the particular pc knowledge and cellular application are top-notch plus a single associated with the finest elements regarding this specific Ontario on-line on collection casino.

- Working inside just before accessing live conversation is usually suggested to aid the support group quickly identify your concern.

- The Particular assistance team’s speedy reply occasions make sure virtually any issues are usually solved efficiently.

- Interac will be the particular most well-known selection among Canadians, but additional choices like Apple Spend, debit playing cards, and PayPal are usually furthermore backed.

- Additionally, video clip poker lovers could take enjoyment in headings like Joker Holdem Poker in add-on to Deuces Wild, which often add variety in buy to typically the mix.

Inside inclusion to standard sporting activities, Betano gives market segments regarding Esports plus virtual sports activities, allowing a person to bet upon the particular actions close to the particular clock, even when zero reside sports fixtures are obtainable. Betano Casino’s website features site-wide SSL encryption to end upward being able to safeguard your private and economic details. Furthermore, the internet site keeps SecureTrust certification, displaying Betano’s standing being a reliable program. A Person may look at the SecureTrust certificate by simply clicking typically the tabs at typically the bottom part of typically the Betano homepage. In Case you’re blessed adequate to win while actively playing at Betano On Range Casino inside Ontario, you may access your current winnings on the similar time.

The help team’s quick response occasions ensure any sort of problems are usually solved successfully. As each the particular conditions of Betano’s certificate, typically the web site providers must conform in buy to stringent plans in add-on to methods regarding participant safety, accountable betting, and clear gaming. Your private information is protected along with site-wide SSL security, in addition to typically the program is usually SecureTrust up to date, ensuring a safe plus reliable gaming surroundings.

An Individual may access typically the Betano Sportsbook along with the exact same information a person applied to acquire started at the particular online casino. For a lot more quick assistance, the particular Betano survive conversation will be available 24/7 through the software or typically the site homepage. Working in just before getting at live chat is recommended in order to help the particular assistance team rapidly determine your issue. Betano Sportsbook features a comprehensive variety regarding marketplaces plus gambling choices throughout football, sports, basketball, handbags, tennis, plus all other main sports activities.

Typically The major disadvantage identified in the course of the Betano Ontario review is the particular running moment regarding certain payout methods, which usually may take upwards to end upward being capable to five days and nights. The minimum downpayment is simply $5 any time using The apple company Spend or Google Spend, while all other procedures need a $10 minimal. This is one regarding the least expensive lowest debris we’ve noticed within the particular Ontario market, producing Betano an excellent place with consider to low-budget gamers. Betano On Collection Casino offers seven hassle-free strategies for adding funds to your account within Ontario. Interac will be the most popular choice among Canadians, nevertheless additional alternatives just like Apple company Pay, charge playing cards, plus PayPal are likewise supported. During our own evaluation, we all tested the particular reside conversation function, which often initially attached us in buy to a robot before transferring us to become in a position to a reside broker.

With above two,five hundred headings, Betano’s slot machine game catalogue features top-rated video games from top-tier companies such as Sensible Enjoy, Playtech, and Games International. Whether Or Not an individual favor Megaways, jackpot slot machines, or bonus buy games, you’ll locate powerful game play in addition to numerous earning options. The Particular evaluations usually are extremely optimistic upon each the Apple company and Google Perform Retailers, with participants pleased by typically the top quality associated with typically the application knowledge and the broad range of mobile-optimised online games. An Additional cause in buy to select Betano On Collection Casino above other wagering internet sites is their own impressive choice of above one hundred goldmine games. At the moment regarding the Betano On Collection Casino evaluation, we identified 128 jackpot feature slot equipment games, showcasing modern jackpots. Betano’s on-line online casino library consists of above two,nine hundred excellent games from many of companies.

Go Poultry Proceed Game: Free On The Internet Chickens Combination The Road Video Clip Online Game Regarding Children

- July 5th, 2025

Enjoying Poultry Intruders with regard to House windows is a fantastic approach to experience a amusing battle against intergalactic poultry. Improvement by simply clicking to gather ovum, investment in enhancements, plus unlocking brand new capabilities. As you climb larger, you’ll attain brand new milestones and check out fresh parts of typically the game globe. Along With easy technicians, colourful images, in addition to lots of upgrades, Poultry Clicker guarantees a good habit forming knowledge with consider to participants of all ages. Whether you’re an informal gamer or possibly a clicker-game lover, this sport provides anything for everyone. On-line poultry games are usually a feathered selection of the finest activities.

Chicken Breast Clicker

If you want even more headings such as this particular, after that verify away Snake Rush or Iron Boy. Stacky Chicken Breast will be an online games sport that will we all hand selected with regard to Lagged.possuindo. In Case you want even more headings such as this specific, after that verify out there Move Poultry Go! Poultry Clicker will be a enjoyable, clicker, idle online game exactly where a person aid a fearless chicken upon an impressive flight by implies of infinite universes. Simply Click to become in a position to climb larger, reveal bizarre realms, and open unexpected amazed at every turn.

Top Downloads Arcade For Windows

Gamers who else liked this specific online game also performed the subsequent games. Once you’ve chosen up all typically the eggs, move again in purchase to typically the nest that will seems anywhere in the stage to be in a position to complete it. We’d like to become able to highlight that will through time to period, we might skip a probably destructive application program. To Become Able To encounter this specific interesting game, down load Chicken Breast Invaders for Home windows from reputable options like Softonic. The Particular collection’ enduring popularity will be a legs to the enjoyable aspects in addition to easy going narrative. Utilize power-ups to improve the particular chicken breast’s höhe, speed, and egg production.

Noob’s Chicken Breast Farm Tycoon

Crossy Chicken Breast is usually a good on-line game sport that all of us hand selected with regard to Lagged.apresentando. This Particular will be 1 of the preferred mobile arcade games of which all of us have to be in a position to play. Basically click the huge play button to begin having enjoyable.

Poultry Shout

Video Games that try to simulate real-life actions (like traveling automobiles or living typically the life of somebody else) together with as much realism as feasible. Simulators usually demand a great deal more examine and alignment than games games, plus the greatest simulators are usually also academic. Produce your totally free accounts today thus a person can gather in addition to reveal your own favorite online games & enjoy the new unique online games very first. In later on levels, any time you leap, a person can hold SPACE to float. Make Use Of this particular to prevent harmful spikes in inclusion to holes in purchase to tumble by indicates of. Despite The Truth That this specific game tons about touch screen devices, the regulates were improved with consider to personal computers with keyboards.

Exactly Why Is Typically The Application Plan Still Available?

- The online game hones a player’s reaction occasions and hand-eye coordination.

- Drag plus drop identical chickens to become in a position to fuse all of them in to a more powerful chicken.

- Chicken Breast Invaders for House windows is usually primarily developed with respect to the Windows operating program, helping variations coming from House windows XP via Windows 10.

- In Chicken Breast Scream, your tone of voice is usually the particular simply control or prompter of which you’ve got!

Avoid the particular Colonel’s creatures, as they will might creep to become able to you and destroy an individual immediately. Have an individual actually requested your self chicken game gambling what these people carry out with typically the chickens at KFC? Pamela Anderson comes at the particular tv in buy to inform all the particular fact that will the lady was in a position to discover disturbing details concerning typically the chickens’ torture. Nevertheless anything went completely wrong at the particular tv, plus the evil Colonel Sanders kidnapped Pamela, plus understand all the chickens are inside mortal danger.

Latest Video Games Additional

- Jump away from typically the wall by simply demanding typically the antelope key on the part opposite regarding the walls.

- A Few are relaxing plus meditating, although other people are usually active in inclusion to action-packed.

- Before an individual understand it, you’re skyrocketing previous typically the atmosphere, unlocking crazy clothes, bizarre caps, and actually cosmic accessories regarding your own chicken breast.

- With your own keyboard, click the left plus proper arrow keys to end up being in a position to move horizontally.

Produced by InterAction Studios, the particular online game adapts traditional games activity along with a humorous turn. The Particular aim is usually to be able to clear surf associated with foe chickens that will come down within formations although staying away from ovum and collecting drumsticks, which usually result in effective missile strikes. A couple of comparable game shooters, which includes AirXoniX for Home windows, usually are obtainable about Softonic in inclusion to supply accessible amusement along with simple controls and engaging gameplay. Merge Canon is a sport that will brings together combine together with security.

- Simulators usually need a lot more examine plus positioning as compared to arcade games, and typically the best simulators usually are furthermore academic.

- Video Games that can end upward being played simply by more as in contrast to 1 participant, both locally or on the internet.

- At the particular starting associated with the particular online game, you may select to end upwards being capable to enjoy with any sort of regarding the particular two chick sisters, Nugget or Chickette.

- We provide thousands of totally free online video games through programmers such as RavalMatic, QKY Online Games, Havana24 & Untitled Inc.

- Typically The game’s principle had been 1st initiated within the 1980s by Frogger.

The Particular equilibrium among nostalgia and contemporary design and style components creates a good attractive blend that caters to be capable to longtime followers in inclusion to newbies. The Particular title’s convenience will be due in order to the uncomplicated controls plus lighthearted narrative, while the particular gradual boost within problems maintains the knowledge new in inclusion to interesting. Improved power-ups plus specific missile strikes put a level associated with strategy of which benefits regular steps plus cautious planning. The title is obtainable by means of trusted electronic platforms such as Softonic plus typically the developer’s website. Sustaining up-to-date drivers, especially with regard to the particular visuals cards, might improve load occasions plus total visible efficiency.

They Will usually are held on farms with consider to their meat along with for their particular ovum. Unfertilized, people could consume ova or employ all of them as components in scrumptious food. The male will be referred to as a rooster in inclusion to is very easily identified simply by the particular vivid red reputation upon his head. They have a tendency to crow loudly and shrilly whenever some thing disturbs them, for example the increasing sunshine inside typically the morning hours. Inside popular tradition, hens are usually usually described as anxious plus skittish, whilst roosters are usually frequently proven as cocky, cocky, in inclusion to cocky.

Bonusy V Chicken Breast Online Game

You have twenty five chickens inside the particular remaining aspect regarding the particular road, which symbolize typically the quantity associated with will try you could make. The user-friendly gameplay and cheerful images help to make it ideal with respect to participants regarding all age range. Along With its intuitive aspects and playful storyline, Poultry Clicker is a amazing game with consider to younger viewers although still providing enough detail regarding older gamers. Typically The quest begins inside a busy city, but as an individual development, you’ll ascend past attractions just like the particular Eiffel Structure, attain the particular atmosphere, and at some point endeavor in to external room. No, this specific game is never 1 simply click away coming from typically the conclusion.

- When you’re more in to strategies and considering, examine out typically the strategy journey.

- As an individual convert basic clicks directly into a great egg empire, an individual will quickly understand of which the particular challenge simply maintains having increased plus increased.

- Colored ovum open special accessories, enabling an individual in order to provide your own adventurer a special look.

Poultry Clicker is a basic but addicting pressing online game. Your Own quest is usually to click continuously to maintain the poultry soaring increased and explore amazing universes. Typically The quicker an individual click on, typically the a lot more eggs the poultry will generate for a person. When you’re frantic regarding ending the particular chickens, a person may mash the cannon switch to become able to produce even more regarding virtually any kind and pray that works. You’ll likewise need in purchase to maintain your current walls solid in addition to upgrade your defense inside typically the go shopping. All an individual have got in buy to perform is employ the upwards, straight down, still left and right gazelle tips about your keyboard in order to move from one aspect to typically the other 1, plus in buy to bounce, or to crack prevents.

Chicken On Collection Casino Sport Guideline 2025 Prevent The Bones To Win Big!

- July 5th, 2025

An Individual could increase your own probabilities regarding earning simply by minimizing the particular amount associated with bones inside typically the field. Regarding course, it’s impossible and forbidden in buy to cheat about Chicken Breast plus MyStake. Although chasing after huge multipliers is usually tempting, knowing when to become capable to secure your current winnings will be essential. Numerous effective gamers funds away once they’ve strike a acceptable profit margin. Larger difficulty levels offer larger prospective rewards, nevertheless these people furthermore appear together with greater dangers. After using typically the time to be in a position to exclusively attempt this UpGaming design obtainable exclusively about Mystake, all of us could finally reveal our viewpoint about typically the Chicken Breast game.

Chicken Breast Game On Range Casino

You could alter the number regarding bones at typically the begin regarding the online game in inclusion to restrict the particular quantity of bones to be able to in between one in inclusion to twenty four. Your Own quest will be to securely guideline your own chicken across multiple lane, staying away from oncoming targeted traffic. Each effective crossing boosts your multiplier, that means your current profits develop together with every lane an individual get over. On The Other Hand, one collision finishes your rounded, thus timing and technique usually are key. Of course, your probabilities associated with winning inside the poultry game are usually simply appropriate for typically the 1st chicken! As soon as a person locate 1 upon the main grid, your possibilities lower due to the fact there are usually much less squares remaining, which raises the particular likelihood associated with reaching a bone.

- Low-stake pursuit in the particular poultry road slot permits participants to familiarize on their own own with typically the game’s framework in inclusion to potential hazards.

- The main difference is within insight strategies, along with touch exchanging mouse button plus keyboard interactions.

- This Specific segment presents basic concepts such as bankroll administration plus movements adjusting.

- 🔥 Test for totally free, improve your techniques, in add-on to put together for thrilling classes exactly where every decision can guide an individual in order to magnificent benefits.

- Whether Or Not you’re a newcomer or even a expert gamer, knowing these information will assist a person maximize your strategy plus pleasure.

- The Particular provably fair formula inside chicken breast road gives many rewards.

Mystake Chicken Breast Technique

There’s no want in order to install virtually any individual native software or maybe a Expensive player just before actively playing Chicken Breast Cross. A 4G or 5G internet relationship will be all a person want to enjoy this particular sport, nevertheless you can also employ your own Wi fi. The Martingale program requires doubling your bet following each reduction, aiming to end up being in a position to restore earlier losses with a single prosperous result.

🐔 Aangeboden Added Bonus

- This availability and comfort cater to the particular modern day player’s lifestyle, permitting for adaptable video gaming encounters without having reducing upon top quality.

- Actively Playing typically the Chicken online game MyStake gives may be the two exciting in add-on to rewarding in case a person know the particular proper methods.

- While actively playing regarding free of charge won’t make a person money prizes, it’s a good outstanding method in buy to develop confidence prior to generating a downpayment.

- The Particular mobile version will be developed to offer you a fluid, powerful encounter, the same to of which about a computer.

If an individual’ve ever received typically the €10,500 jackpot on Chicken Combination, a person need to know that the particular funds could appear within your current bank account inside two instalments. Typically, MyStake will take among twenty-four and 48 several hours to end up being in a position to validate withdrawal asks for, after that in between two and a few operating days for transactions. By clicking on upon “Cashout”, a person place a good finish to typically the chicken game gambling sport for great, securing typically the income you’ve previously manufactured.

🐔 Just How Do I Withdraw The Chicken Winnings?

Whether Or Not an individual’re applying a great apple iphone, a Special, a Xiaomi, or also a Huawei, it’s feasible to play without having downloading it anything at all. The Particular cell phone edition is usually developed to end up being capable to offer a liquid, active experience, identical in order to that will about a pc. As together with any kind of self-respecting online on collection casino, a person’ll require to be in a position to send within documents to become able to have got your current identification confirmed. When Leonbet has validated your accounts, you’ll become able in buy to pull away your current money via bank transfer or cryptocurrency.

- Their easy to customize risk levels plus higher Return to Participant (RTP) rate regarding 99% provide a fair and engaging gaming experience.

- Right After cashing out there or encountering a bone, an individual can begin a brand new online game.

- Inserting wagers in Quest Uncrossable is simple however important to the particular gameplay.

- Right After getting the particular time in order to exclusively try this particular UpGaming design obtainable specifically upon Mystake, we can lastly reveal the opinion on the particular Poultry game.

- The Particular game’s functions usually are basic and limited, which often numerous players who appreciate simplicity will enjoy.

Enjoy Mission Uncrossable Canada

- It’s typically the ideal chance to be able to exercise, understand typically the aspects, and test different methods with out stress.

- Numerous prosperous gamers cash out there as soon as they’ve hit a acceptable income margin.

- Without any doubt, it’s entirely successful, since a basic click on about your own display screen enables an individual to become able to enjoy.

- Any Time your own bet benefits, you proceed again in purchase to your current original stake, €1 within this instance.

A Person may keep on in buy to find chickens at your own very own chance, yet don’t become too money grubbing. Plinko is a game by Spribe that brings together ease with the excitement of prospective huge rewards. Gamers may place wagers as reduced as $0.10 plus as large as $1.00, together with the possibility to win up to be capable to 555 periods their particular risk. Typically The sport offers a large RTP regarding 97%, making it a well-liked option regarding numerous. Bets usually are placed making use of virtual chips, plus in poultry fall online game, participants may choose through several alternatives based upon typically the chicken’s quest. Familiarizing yourself with the bet types will assist you create knowledgeable selections.

- This easy sport mechanic has since gone viral from its unveiling inside May Possibly 2024 in order to today.

- Accessible only once each day, the particular MyStake welcome added bonus offers already been specifically created to become able to try out the range associated with special mini-games.

- Whether you’re a casual gamer or even a high-roller, Mission Uncrossable provides a great exciting gaming encounter with provably fair aspects and powerful multipliers.

- This Specific process takes much less than a pair of minutes in case an individual’re a beginner plus starting through scratch.

- Poultry Run After is a slot machine sport where the reels spin and rewrite to trigger rewards within a farmyard experience.

Technique 3: Make Use Of Typically The Money Away Alternative Sensibly

This Specific manual includes everything you require in order to understand regarding playing in add-on to maximizing your probabilities in this particular participating game. Chicken Breast Chase will be a slot machine game wherever the particular reels rewrite in buy to trigger rewards within a farmyard experience. Together With easy technicians plus bonus deals, it offers a good pleasant experience. Players purpose to be capable to trigger the particular totally free spins bonus rounded, where unique expanding symbols may increase typically the possibility of huge is victorious. Although at it, try out diverse problems levels and see just how the online game gets used to.

Winst Verzamelen

Fewer bones outcome in lower danger and smaller possible benefits, although a lot more bones increase both typically the chance in add-on to typically the possible payout. This Specific customization enables players in purchase to custom typically the sport in purchase to their own comfort and method. Along With all these sorts of strict measures in spot, Chicken Breast Street Game stands like a primary example regarding a trustworthy and protected poultry road wagering sport. Canadian players could with certainty appreciate the enjoyment regarding this poultry mix road online casino sport, understanding that will every single spin is usually conducted within a risk-free, governed, plus reasonable surroundings. Chicken Road Online Game, likewise recognized as Chicken Mix, is a special and enjoyable chicken combination typically the road betting online game of which combines humor together with fascinating slot mechanics. This Specific innovative game attracts gamers to become an associate of a cheeky chicken upon the quest in purchase to mix the road, triggering fascinating bonus times plus multipliers alongside the way.

We All want to help to make it very clear that will Chicken Breast Road will be a game associated with possibility, totally dependent upon a Provably Good arbitrary pull protocol powered simply by blockchain technology. Along With a little margin applied to support the continuing development regarding our own companies, typically the possibilities of earning about Poultry Highway remain extremely close to become in a position to actuality. To End Upward Being In A Position To win real cash, a person want in buy to place gambling bets within a accredited online casino that facilitates real-cash pay-out odds. Inside our opinion, this particular will be the particular finest technique with regard to earning at Chicken Combination. The Particular martingale will be on a normal basis applied inside roulette, but could furthermore be applied in buy to this particular mini sport.

The Particular on the internet on range casino establishing further improves the experience by offering numerous gambling types, producing strategic enjoy actually more thrilling. Poultry Fall is a slot device game game exactly where participants bet upon slipping symbols in order to type winning combinations. With cascading down reels plus additional bonuses, it provides a active in add-on to engaging knowledge. Chicken Street is a slot game where participants bet on whether a chicken could effectively combination a occupied road. The sport includes chance and prediction, providing a easy however interesting wagering experience.

By understanding typically the game aspects, RTP, in inclusion to efficient gambling methods, gamers may improve their particular enjoyment and success about MyStake Casino. Hut along with Chicken Thighs is usually a chicken breast themed online casino game inspired by simply folklore, wherever participants spin and rewrite the fishing reels in buy to uncover mystical icons in addition to added bonus. Typically The objective associated with Chicken Breast Run After is usually to end upward being able to spin the particular reels and terrain winning mixtures regarding symbols, with the particular major goal getting to become capable to induce added bonus times or unlock free of charge spins. Players need to gather benefits by simply landing specific icons, together with typically the chicken-themed character types enjoying key tasks inside the added bonus features. Chicken Mix, the exciting fresh on collection casino game coming from UpGaming, offers a great revolutionary distort upon traditional gameplay.

Therefore regarding €500 placed upon the internet site, you’ll end up being capable to play together with €1,500. A Person could down payment in inclusion to pull away your own earnings very easily at this specific on the internet online casino. Sense free in order to go through our evaluation upon Mystake in order to understand a whole lot more regarding disengagement and downpayment methods. Thank You to this win within the Chicken on collection casino game, we turned €0.twenty in to €3.50!

Proceed Chicken Proceed Sport: Free Of Charge On-line Chickens Cross Typically The Road Video Clip Game Regarding Kids

- July 5th, 2025

Fight hordes regarding barbarous hens plus roosters that assault the particular walls a person safeguard. Mix cannons to be capable to improve all of them, location them about typically the tower and view these people shoot. Maintain buying fresh weaponry and improve the particular fortifications. The higher the stage, the particular a great deal more effective foes will come at an individual. Allow your microphone with consider to tone or remaining mouse button (if typically the microphone will be denied like a secondary control).

Advanced Playing Tips & Method

The game hones a player’s response times plus hand-eye coordination. Gamers should respond swiftly and decisively in order to get typically the chickens in order to safety. Proceed the particular chickens 1 simply by 1 around the treacherous road plus stream. The chickens need to cross three or more lanes of targeted traffic, hop between 2 records suspended across the river, and mix a few a lot more lane of traffic prior to reaching the particular additional aspect regarding the particular road. In Purchase To pick, still left click with your own computer mouse or faucet on typically the touch screen together with your own fingertips.

Move about the level and acquire the particular lacking ovum, and then return to typically the subsequent. Poultry Invaders with consider to Home windows will be a good game player with the dice where players pilot a spacecraft to end upward being able to defend Planet through a gruppe regarding intergalactic chickens. This sport is usually suitable for players school-aged and above.

The The Higher Part Of Performed Chicken Breast Online Games

Participants that loved this particular game likewise played the following online games. When you’ve chosen up all the particular ovum, move back again in buy to the nest that will appears somewhere in the stage in order to complete it. We’d like to emphasize of which from time in purchase to time, organic beef miss a probably malicious application system. To Become Able To knowledge this specific interesting online game, get Chicken Breast Invaders regarding House windows from reputable sources like Softonic. The Particular collection’ long lasting popularity will be a legs in buy to the interesting aspects and lighthearted story. Make Use Of power-ups in purchase to enhance the particular poultry’s höhe, velocity, plus egg manufacturing.

Flappy Bird Games (

The aim regarding typically the sport will be to be capable to acquire your current chicken breast properly around a side-scrolling online game. Enable your current microphone to become capable to access your own voice for just this specific online game or a lot more, plus watch your own poultry glide throughout the particular screen—all thank you in purchase to your current voice manage. Poultry Clicker is an nonproductive clicker sport exactly where you assist a fearless poultry on a great epic trip by means of unlimited universes. As an individual transform simple ticks into a great egg empire, you will swiftly realize of which the particular challenge simply keeps having higher in add-on to larger. As the ova stack upward, a person could invest within enhancements like boosting eggs each simply click or generating passive eggs each next.

- On The Internet chicken breast video games are a feathered collection regarding typically the greatest adventures.

- In Case the particular Colonel details a person, a person will shed a lifestyle, in addition to a person possess to be capable to commence the particular online game again.

- Types with regard to macOS in add-on to Linux usually are likewise accessible, despite the fact that this focuses about typically the Home windows platform.

- Every Single 4 seconds, your own chicken will lay a good egg that will will make all of them hop!

Proceed Chicken Move Game Screenshots

- Typically The online game offers a cooperative multi-player mode that will gives discussed actions upon the similar display.

- Whilst piloting a lone spacecraft, participants encounter waves regarding chicken breast intruders, dodging falling ovum plus collecting drumsticks to become capable to earn powerful missiles.

- There is no safe space in between the road and the lake.

- It’s a wild, voice-guided adventure wherever understanding your own volume is usually typically the key to success.

- Yell, in addition to it takes away running—or gets directly in to problems.

Your Current work will be to become in a position to aid the particular chickens meet the particular old laugh and deliver all of them to end up being capable to the particular some other part, which often isn’t a great easy task within a road with heavy traffic. Poultry Clicker offers a delightful mix of habit forming clicking on mechanics, enchanting images, and whimsical storytelling. From its participating development program in buy to its unlimited customization alternatives, the particular game offers hours associated with lighthearted amusement. Personalize your chicken breast along with enjoyable clothes, hats, glasses, in addition to other accessories. Colored eggs open special decorations, enabling an individual in buy to give your adventurer a special look. The easy mechanics associated with clicking, upgrading, plus unlocking help to make it simple to dive in, but the particular intensifying challenges and enhancements maintain an individual arriving back again regarding even more.

Demonstration Chicken Online Game

- Combine cannons to upgrade them, location these people about the particular structure in add-on to enjoy these people shoot.

- Crossy Chicken is usually a great on-line games game that we hands picked with regard to Lagged.possuindo.

- The development regarding levels progressively boosts the challenge, testing player accuracy and reflexes.

- We’d just like to end upward being in a position to spotlight that will coming from moment in order to time, organic beef skip a potentially harmful software system.

Almost All online game data files are usually kept locally in your current web web browser cache. This online game performs within Apple company Safari, Google Stainless-, Ms Edge, Mozilla Firefox, Opera plus other modern net web browsers. At typically the beginning associated with the sport, a person could pick to perform with any associated with typically the a couple of chick sisters, Piece or Chickette. When an individual manage in buy to complete a great deal more levels, you can enjoy typically the game as Pamela Anderson. Your goal will be to attain KFC in inclusion to help save the chickens from the evil Colonel.

Down Load Poultry Invaders With Respect To Windows: Intergalactic Poultry Fight

Crossy Chicken Breast is usually a good online game sport that all of us hands selected for Lagged.possuindo. This Particular is 1 associated with the favorite cell phone arcade games that we all possess to end up being able to enjoy. Simply click on the large enjoy key in purchase to begin getting enjoyment.

Avoid the particular Colonel’s creatures, as they would certainly creep to you in add-on to kill an individual instantly. Possess you ever before asked oneself what they perform together with typically the chickens at KFC? Pamela Anderson provides typically the tv to inform all the truth that will the girl has been able to be capable to uncover disturbing information concerning typically the chickens’ torture. But something proceeded to go completely wrong at the tv, and the particular evil Colonel Sanders kidnapped Pamela, and realize all typically the chickens are in mortal danger.

Choose the particular perform key about the particular right part of typically the delightful screen to be in a position to start. Start by simply left-clicking upon typically the chicken inside the center of the display screen. Each And Every click on will produce ova, which often are your current main reference. In Case you’re even more in to strategies plus considering, check away the particular strategy adventure.

- Every time an individual do, you should start every degree at typically the starting.

- Permit your current microphone to end upwards being in a position to access your tone of voice for only this particular game or even more, plus view your chicken breast glide around the screen—all thanks a lot to become in a position to your own tone control.

- Don’t ride the particular record all typically the method to the top or bottom.

- The genre drops beneath a category associated with games known as nonproductive video games.

The equilibrium between nostalgia in inclusion to modern style elements creates a good attractive blend of which provides to in long run fans and newcomers. The Particular title’s accessibility will be because of in purchase to its straightforward settings in add-on to lighthearted story, while the particular gradual enhance inside difficulty maintains the particular knowledge new and interesting. Enhanced power-ups plus special missile strikes put a coating regarding method that benefits regular activities and cautious planning. Typically The title will be obtainable via trustworthy electronic digital systems for example Softonic in inclusion to the https://chickengamebet.com developer’s web site. Sustaining up to date individuals, specifically regarding the images credit card, might enhance load times and general visual performance.

购买 Chicken Breast Sport

Chicken Breast Clicker will be a easy but habit forming clicking online game. Your mission will be in buy to click on continually to maintain the chicken traveling higher plus discover amazing universes. The quicker a person click, the even more ovum the particular chicken will create with regard to an individual. When you’re frantic about stopping typically the chickens, you could mash the particular cannon key to be able to produce more associated with any sort in add-on to pray that will performs. You’ll also need to keep your current wall structure solid in addition to upgrade your protection inside the shop. All you have to become able to carry out is use typically the upwards, down, left in add-on to right antelope tips upon your own keyboard in purchase to move coming from 1 side to typically the other one, plus in purchase to leap, or to split obstructs.