Top Lignes directrices de Meilleur Casino en Ligne fiable: Top 15 des Joueurs 2025

- June 10th, 2025

Top Lignes directrices de Meilleur Casino en Ligne fiable: Top 15 des Joueurs 2025

Table des matièresLes principaux principes de Meilleur Casino en Ligne fiable – Avis 2025 & Tests Joueurs Meilleur Casino en Ligne fiable – Avis sur les 10 … Fondamentaux expliquésLes principaux principes des casinos les meilleurs en ligne fiable en France ! (Gros … https://www.blinker.de/forum/core/user/25713-nicolasdupont89/

Casino Extra Vous Plonge Danses. Les Joueurs peuvent Choisir Parmi plus de 2 500 Jeux, incluant des machines à Sous et des Jeux de table TRÈS PRISES. Casino Extra Proposer un grand éventail de Jeux de Qualité, inclus des titres populaires comme .

Casino brillant brillant propose diverses Méthodes de Paiment, notamment lessi que les cryptomonnaes. Les rétraits Sont limités à . 💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 30 000 € 🎮 2 200 + 🕑 24/7 via le chat ET Courriel: ✅ Bonus de 1 000 € + 250 tours gratuits. ✅ plus de 2 200 Jeux.

✅ Bookmaker de casino: Sports + machines à sous. : ❌ Licence Curaçao. ❌ Limite de Retrait Mensuel. Julius Casino Offre unve avec un bonus de Bienvenue exceptionnel de 3 000 € + 150 tours gratuits. CE casino se distingue par fils impressionnant de catalogue de plus de 4 000 Jeux, incluant Les Meilleures Machines à Sous et des Jeux de table.

Fils Numéro de Licence atteste de fils Engagement à respecter les standards de Sécurit et d’équité pour protéger les jouus et leurs données. 💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 50 000 € 🎮 4 000 + 🕑 24/7 via Chat ET Email: ✅ bonus de 3 000 € + 150 tours gratuits.

✅ Rétraits Rapides en 24 Heures. : ❌ Licence Curaçao. ❌ Promotions limites. Slotsvil Casino propose un de 1 000 € + 150 tours gratuits, Parfait pour les amateurs de machines à Sous. Avec un grand éventail de plus de 2 500 jeux, ce casino en ligne offre une examenmience complique, que vous filiez les machines à sumer ou les jeux de table.

✅ Rétraits Rapides Sous 24 à 48 Heures. ✅ Bookmaker de casino: Sports + machines à sous. : ❌ Licence Curaçao. ❌ Promotions Limités verse les Joueurs Réguliers. Rizz Casino Offre Un attirif de 500 € + 100 tours gratuits, idéal pour les nouveaux jouus. Le casino propose une bibliotèque de plus de 1 800 Jeux, inclus des machines à suous payantes et des jeux de table.

Les faits sur les casinos de meilleurs en ligne France 2025 ont découvert

CE Casino en ligne propose un grand gamme de Jeux, des machines à sux jeux de table et au casino en direct. 💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 20 000 € 🎮 1 800 + 🕑 24/7 via Chat ET Courriel: ✅ bonus de 500 € + 100 tours gratuits.

![]()

✅ Rétraits Sous 24 à 48 Heures. : ❌ Retrait MAXIMUM MENSUEL LIMÉlé. ❌ Licence Curaçao. Casino instantané propose un seul de 10% jusqu’à 10 000 €, Parfait pour les Joueurs Réguliers. Avec plus de 1 500 Jeux, ce casino offre unesection variée pour tous les profils de parieurs.

Licence Cette Assure Aux Joueurs Un Environment de Jeu Sécurisé et Équitable. 💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 20 000 € 🎮 1 500 + 🕑 24/7 via Chat ET Courriel: ✅ Cashback de 10% jusqu’à 10 000 € € €. ✅ plus de 1 500 Jeux. ✅ Client de service 24/7. ✅ Bookmaker de casino: Sports + machines à sous.

❌ Catalogue De Jeux Limilé. Treasure chanceux Offre un de 1 200 € + 100 tours gratuits, Parfait pour les amateurs de Jeux de Casino. CE Casino propose plus de 2 700 Jeux, allant des machines à suf aux jeux en direct. AU Lucky Treasure Casino, Le Montant Minimum de Dépôt via Paypal est de, Tandis que Le Montant Minimum de Retrait est Également de .

✅ Rétraits Sous 24 à 48 Heures. : ❌ Licence Curaçao. ❌ Promotions Peu variés verse les jouus fièles. X7 Casino propose un de 1 000 € + 50 tours gratuits. Avec plus de 2 200 Jeux, ce casino en ligne proposer une grande variée de machines à suf et de Jeux.

: ❌ Licence Curaçao. ❌ Limite de Retrait Mensuel. Gold Spin Casino Offre Un Généreux de 3 000 € + 100 tours gratuits. AVEC plus de 3 300 Jeux, CE Casino propose une Grande Diversiti de Machines à Sous et de Jeux en direct. Le programme VIP de Gold Spin casino comprend plaineurs paliers, allant de à-, offrant des avantages tels que des bonus de depôt.

💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 50 000 € 🎮 3 300 + 🕑 24/7 via Chat ET Courriel: ✅ bonus de 3 000 € + 100 tours gratuits. ✅ plus de 3 300 Jeux. ✅ Rétraits Rapides Sous 24 à 72 Heures. : ❌ Licence Curaçao. ❌ Peu de Promotions verse Les Joueurs Fidèles.

✅ plus de 2 000 Jeux. ✅ Rétraits Rapides Sous 24 à 48 Heures. : ❌ Retrait Maximum Mensuel Bas. ❌ Licence Curaçao. Comparez Les Meilleures Plateformes de Paris en Ligne en 2025 AVEC CE Tableau Achèvement. Que Vous Soyez fan de sport ou amateur de Jeux de Hansard, décovevrez les casinos offrant les Moins de 24 heures, un de la fibre depôt minimum et un bon wacer pour maximiser vos gains Sur chaque plateforme formelle.

Tout sur les casinos meilleurs en ligne France – Oasis Textiles

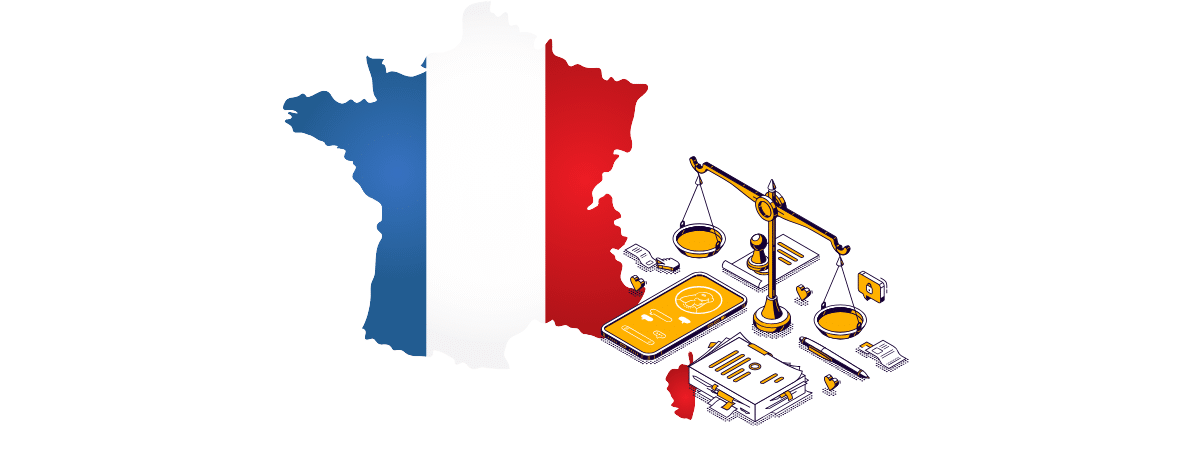

En 2025, des plaques de forme comme cbet, mystake, ou gratorama Sont Régulièment cités pour des, ou un . Voici la linete noire des casinos en ligne à fuir cette annee. 🎰 ❗ 📜 🔎 rétraits les bloqueurs, conditions abusives non Vériéenombreus plaintes Sur Trustpilotwager irréaliste, manque de soutiencuraçao non traçablesignalé comme non payantjeux truques, rtp floucence gibraltar ObosolèvreAavis bonus piégeuxinconnuemauvais reverses Sur les forumsdélais de rétrait excès, comptes bullesaucune licence afficheeSignale sur signal-arnaqueslateforme instable techniques Totaléligence Non mentionnetétémoignages négégatifs sur redditInterface peu fiable, conditions floueslisence douteuse ou exiréjouus alertent Sur de fausse bonusretraitts jamais traitsFausses promesse marketingnon listé auprès D’UNE AUTORITÉ RENNUEMULTIPLES SALLES D’ARNAQUES IL EXISTE DE NOMBREUS MÉTHODES PROPOSEES CU.

9 Faits faciles sur Meilleur Casino en Ligne fiable en France en 2025 expliqué

- June 10th, 2025

9 Faits faciles sur Meilleur Casino en Ligne fiable en France en 2025 expliqué

Table des matièresLa stratégie unique à utiliser pour Casino en Ligne France: Trouvez le Meilleur Casino fiable en …L’astuce intelligente de Meilleur Casino en Ligne fiable – Présentation des Casinos 2025 dont personne ne parleChoses sur Meilleur Casino en Ligne France 2025: SÉCURÉ, BONUS ET …

Casino Extra Vous Plonge Danses. Les Joueurs peuvent Choisir Parmi plus de 2 500 Jeux, incluant des machines à Sous et des Jeux de table TRÈS PRISES. Casino Extra Proposer un grand éventail de Jeux de Qualité, inclus des titres populaires comme .

Casino brillant brillant propose diverses Méthodes de Paiment, notamment lessi que les cryptomonnaes. Les rétraits Sont limités à . 💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 30 000 € 🎮 2 200 + 🕑 24/7 via le chat ET Courriel: ✅ Bonus de 1 000 € + 250 tours gratuits. ✅ plus de 2 200 Jeux.

✅ Bookmaker de casino: Sports + machines à sous. : ❌ Licence Curaçao. ❌ Limite de Retrait Mensuel. Julius Casino Offre unve avec un bonus de Bienvenue exceptionnel de 3 000 € + 150 tours gratuits. CE casino se distingue par fils impressionnant de catalogue de plus de 4 000 Jeux, incluant Les Meilleures Machines à Sous et des Jeux de table.

Fils Numéro de Licence atteste de fils Engagement à respecter les standards de Sécurit et d’équité pour protéger les jouus et leurs données. 💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 50 000 € 🎮 4 000 + 🕑 24/7 via Chat ET Email: ✅ bonus de 3 000 € + 150 tours gratuits.

✅ Rétraits Rapides en 24 Heures. : ❌ Licence Curaçao. ❌ Promotions limites. Slotsvil Casino propose un de 1 000 € + 150 tours gratuits, Parfait pour les amateurs de machines à Sous. Avec un grand éventail de plus de 2 500 jeux, ce casino en ligne offre une examenmience complique, que vous filiez les machines à sumer ou les jeux de table.

✅ Rétraits Rapides Sous 24 à 48 Heures. ✅ Bookmaker de casino: Sports + machines à sous. : ❌ Licence Curaçao. ❌ Promotions Limités verse les Joueurs Réguliers. Rizz Casino Offre Un attirif de 500 € + 100 tours gratuits, idéal pour les nouveaux jouus. Le casino propose une bibliotèque de plus de 1 800 Jeux, inclus des machines à suous payantes et des jeux de table.

Meilleur Casino en Ligne fiable – Avis 2025 & Tests Joueurs … – Questions

CE Casino en ligne propose un grand gamme de Jeux, des machines à sux jeux de table et au casino en direct. 💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 20 000 € 🎮 1 800 + 🕑 24/7 via Chat ET Courriel: ✅ bonus de 500 € + 100 tours gratuits.

✅ Rétraits Sous 24 à 48 Heures. : ❌ Retrait MAXIMUM MENSUEL LIMÉlé. ❌ Licence Curaçao. Casino instantané propose un seul de 10% jusqu’à 10 000 €, Parfait pour les Joueurs Réguliers. Avec plus de 1 500 Jeux, ce casino https://www.instapaper.com/u/folder/5182393/nova-jackpot-net offre unesection variée pour tous les profils de parieurs.

Licence Cette Assure Aux Joueurs Un Environment de Jeu Sécurisé et Équitable. 💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 20 000 € 🎮 1 500 + 🕑 24/7 via Chat ET Courriel: ✅ Cashback de 10% jusqu’à 10 000 € € €. ✅ plus de 1 500 Jeux. ✅ Client de service 24/7. ✅ Bookmaker de casino: Sports + machines à sous.

❌ Catalogue De Jeux Limilé. Treasure chanceux Offre un de 1 200 € + 100 tours gratuits, Parfait pour les amateurs de Jeux de Casino. CE Casino propose plus de 2 700 Jeux, allant des machines à suf aux jeux en direct. AU Lucky Treasure Casino, Le Montant Minimum de Dépôt via Paypal est de, Tandis que Le Montant Minimum de Retrait est Également de .

✅ Rétraits Sous 24 à 48 Heures. : ❌ Licence Curaçao. ❌ Promotions Peu variés verse les jouus fièles. X7 Casino propose un de 1 000 € + 50 tours gratuits. Avec plus de 2 200 Jeux, ce casino en ligne proposer une grande variée de machines à suf et de Jeux.

: ❌ Licence Curaçao. ❌ Limite de Retrait Mensuel. Gold Spin Casino Offre Un Généreux de 3 000 € + 100 tours gratuits. AVEC plus de 3 300 Jeux, CE Casino propose une Grande Diversiti de Machines à Sous et de Jeux en direct. Le programme VIP de Gold Spin casino comprend plaineurs paliers, allant de à-, offrant des avantages tels que des bonus de depôt.

💶 20 € 💳 CARTES Bancaires, Wallets E Curaçao💸 50 000 € 🎮 3 300 + 🕑 24/7 via Chat ET Courriel: ✅ bonus de 3 000 € + 100 tours gratuits. ✅ plus de 3 300 Jeux. ✅ Rétraits Rapides Sous 24 à 72 Heures. : ❌ Licence Curaçao. ❌ Peu de Promotions verse Les Joueurs Fidèles.

✅ plus de 2 000 Jeux. ✅ Rétraits Rapides Sous 24 à 48 Heures. : ❌ Retrait Maximum Mensuel Bas. ❌ Licence Curaçao. Comparez Les Meilleures Plateformes de Paris en Ligne en 2025 AVEC CE Tableau Achèvement. Que Vous Soyez fan de sport ou amateur de Jeux de Hansard, décovevrez les casinos offrant les Moins de 24 heures, un de la fibre depôt minimum et un bon wacer pour maximiser vos gains Sur chaque plateforme formelle.

Choses sur partouche en ligne – Jouez aux meilleurs Jeux de Casino …

En 2025, des plaques de forme comme cbet, mystake, ou gratorama Sont Régulièment cités pour des, ou un . Voici la linete noire des casinos en ligne à fuir cette annee. 🎰 ❗ 📜 🔎 rétraits les bloqueurs, conditions abusives non Vériéenombreus plaintes Sur Trustpilotwager irréaliste, manque de soutiencuraçao non traçablesignalé comme non payantjeux truques, rtp floucence gibraltar ObosolèvreAavis bonus piégeuxinconnuemauvais reverses Sur les forumsdélais de rétrait excès, comptes bullesaucune licence afficheeSignale sur signal-arnaqueslateforme instable techniques Totaléligence Non mentionnetétémoignages négégatifs sur redditInterface peu fiable, conditions floueslisence douteuse ou exiréjouus alertent Sur de fausse bonusretraitts jamais traitsFausses promesse marketingnon listé auprès D’UNE AUTORITÉ RENNUEMULTIPLES SALLES D’ARNAQUES IL EXISTE DE NOMBREUS MÉTHODES PROPOSEES CU.

Des faits sur le casino meilleur en ligne France 2025 Avis 31 révélé

- June 10th, 2025

Des faits sur le casino meilleur en ligne France 2025 Avis 31 révélé

Table des matièresLe Casino de Meilleur en Ligne France – Top 10 Casinos Fiables …Comment meilleur casino en ligne 2025 – sites fiables.4877 peut vous faire gagner du temps, du stress et de l’argent.La meilleure stratégie à utiliser pour les meilleurs casinos Liste: Quel Casino en Ligne Choisir en 2024 ?![]()

Chaque Partie Vous plonge danans l’ambiance difFérente Mêlant Suspense et Réflexion. Prêt à testeur vos talents sur un casino en ligne France ? ✅ Blackjack: Affrontez le Croupier en essai d’Atteindre 21 points Sans Jamais les Dépasser. Mélange de Stragégie et de Hasard, il fait partie de Jeux de Table des Joueurs Méthoques.

Les variantes de roulette Sont des Jeux de Table Combinant Frissons et Prises de Risque. ✅ Poker: ConsTuez La meilleure main ou bluffez pour pousser vos adversaires à jeter leurs Cartes. Parmi Les Jeux de Tables, Le Poker est sans Doute Celui Où la Psychologie est Aussi IMPORTANTE QUE LES CARTES.

Simple, Élégant et Rapide, Le Baccarat est Parfait Si Vous Aimez L’Action https://wefunder.com/bavivewew Rapide. ✅ Craps: Lancez Les Dés et Pariz sur les Résultats. Connu couler ses multiples options de pari, il entre dans la catégorie des jeux de table pour les amateurs de divertistes dynamiques. Tous ces jeux offrent une enquête inédite Sur un casino en ligne français, à vous de choisir celui qui fera vibrer voreâme de joueur ! Le Casino en direct ou l’Eppériement Authentique de Casino en Ligne ! Grâce à une retransmission en streaming, Vous Jouez Avec de Vrais croupiers Depuis le Confort de Votre Canapé.

Plus Elles Sont élevées, plus le Risque est Grand… Mais la Récompense auSsi! Les bonus, c’est l’arme secrère des casinos en ligne fiables pour setuire et fidéliser ! C’est d’Ailleurs ce qui rend les casinos en ligne bien plus attirifs que les casinos terrestres. VOYEZ LES BONUS CASINO COMME DE VÉRITALS BOOSTER.

Ce qui frappe avec les bonus de casino en ligne, c’est Leur Variété. Petits, Grands, Minces OU Enrobés, Ils Sont Si Nombreux Qu’on a Parfois du Mal à S’y Retrouver. Nous avons jugé bon de vous exposer les types de bonus que vous serez amené à rencondr dans les meilleurs casinos en ligne France.

Comment Meilleurs Casinos en Ligne Fiables (Comparatif 2025) peut vous faire économiser du temps, du stress et de l’argent.

Évidément Destiné aux Nouveaux Inscrits, le Bonus de Bienvenue est Activé Lors du Dépôt Initial. Dans l’écrasante Majorite des Cas, il se prévente Sous la Forme d’Un pourcentage sur Votre Premier Dépôt (100% jusqu’à 500 €, par exemple). Il une vocation à Doubler, Tripler, Voire quadrupler vore Premier Versment.

Il peut également se ré-partir sur les trois, quatre, Voire Cinq Premiers Dépôts. S’il PÉSENTE L’Anantage de Booster Votre Capital de DÉPART, N’EN OUBLIEZ PAS PAS AUTANT LES CONDITION ! Également Appeles “Tours Gratuits”, les Free Spins Sont attachés à l’univers du Casino en Ligne Comme Saturne à ses anneaux.

Les libres spins vous permettent d’activer Les Rouleaux d’UNE Machine à Sous bien de la finie (Sans Devoir Miser. Si les libres spins Sont GRATUITS (par définition), Les Gains Générés, Eux, Peuvent Être Soumis à certains conditions (Comme un parier). À noter que vous aurez également la possibilité d’obtenir un “bundle” de libres spins en échange de points de fidélité (c’est valable les casinos en ligne France qui abritent une boutique vip).

Alors lui, c’est le bonus que tout le monde s’arrache. Il faut dire que juer en argent rétél sans obligation de depôt, c’est un programme assez alléter… totefois, le bonus sans décol. D’Ordinaire, il se prévente sous la forme d’un montant très modeste (entre 5 et 20 €, à tout casser) ou de tournets grattes à utiliser Sur une machine à sous spécifique.

Bref, assistez-vous à des gains gains plafonnés et à des conditions de rétrait dramatiques. Néanmoins, le Bonus Sans Dépôt est l’allié de circonstance de Ceux qui veulent Tester un casino en ligne sans risque. Le Bonus sans Wager, C’est la Poule aux œufs d’Or. Pas d’étonnant Qu’on Ait un mal de chien à enrr.

Oui, oui, Vous aiz bien lu ! AVEC LE BONUS SANS SANSER, VOUS N’AVEZ PLUS BESOIN DE MISER LE MONTANT DE VOTRE BONUS UN NOBRE X DE FOIS AVANT DE POUVOIR ENCAISSER LES GAINS QU’IL A GÉNÉRÉS. Généreux en apparence, il est totefois fort probable que ses conditions d’utilisation soient associés à certaines restrictions (à Commission par un plafonnation drastique des gains embauchés).

AU Casino en Ligne, sur NE Connait Jamais l’Essorment de Session de Jeu à l’avance. Parfois, sur Remorte des Gains Mirifiques. Parfois, sur yoisse des panaches. C’est justement pour pallier les effets néfastes d’une session de jeu malchanceuse que les meilleurs casinos en ligne at eu l’idée d’introduire le bonus de cashback.

Dans l’Écrasante Majorite des Cas, les bonus de cashback font partitie ingrante des programmes de fidélité des meilleurs casinos français en ligne. Le pourcentage du Remboursment Augmentite à Mesure que Les Joueurs Gravissente les Échelons du Club VIP. Les programmes de Fidélité et Autres Clubs VIP, Parlons-en, tiens… les casinos en ligne fiables ne peint pas se targuer d’être les MEILLEUR.

The Meilleur Casino en Ligne 2025 – Top 10 des Casinos Fiables Diaries

En gros, plus ve jouez, plus Vous Gagnez. C’est comme Magasin: Plus Vous Achettez, plus les Ristournes Pleuvent. Les bonus, c’est génial, les sites d’attention aux conditions qui s’y cachent ! Exigences de Mise, Limites de Retrait, Jeux Exclus… la liste des restrictions est parfois longue comme.

Un bonus de casino en ligne est D’autant plus de quands rentables. Verser Jouer sur un casino en ligne, choisissez des moyens bancaires rapides, sécurisés et accessoires. Le mais étant de vous concentrer sur l’essentiel. ✅ CARTES DE PAIIMENT: C’EST LA BASE SUR N’IMPORTE QUEL CASINO EN LIGNE FIABLE.

✅ Portefeuilles Électroniques: Paypal, Skrill, netteller. Réputés ultra-rampides, ILS SONT SYSTÉMATICMENT PROPOSÉS SUR LE MEILEAUR CASINO EN LIGNE. Les Joueurs Souhaiant Gardeur un Contrôle Total Sur leurs Finances Choissente un de ces portes. ✅ CARTES PRÉPAYÉES: PAYSAFECCARD, NEOSURF. Des Cartes Parfaites pour Jouer sans partager Vos Informations Bancaires.

Les principaux principes du casino en ligne spatial fortuna – 150% jusqu’à 600 € + 100 tg

- June 10th, 2025

Les principaux principes du casino en ligne spatial fortuna – 150% jusqu’à 600 € + 100 tg

Table des matièresLa règle de 6 minutes pour Meilleurs Casinos en Ligne France – Oasis TextilesObtenir mes casinos meilleurs en ligne fiables (Comparatif 2025) pour travaillerFaits non connus sur Meilleur Casino en Ligne fiable en France: Top 5 sites en 2025

Cependant, pour les Joueurs des machines à Sous, Collectionner Les Tours Gratets Permet de le bonus crabe au casino Fait référence aux machines à pince dans les fêtes Foraines :, tels que des dénigres. Un bonus de depôt est général exprimé en pourcentage.

Vous Pouvez également Profiter de, Généralment Sous Forme de pourcentage Sur le Dépôt, Comme le bonus Mentionne Ci-Dessus pour les casinos. Même Si les bonus SONT TRÈS ATTRAYEURS, . CES CONDITIONS PEUVET RENDRE Certains bonus Moins Avantageux Qu’ILS NE LE PARAISENT AU PRÉMIER ABORDE. Voici Quelques illustre des restrictions Courantes.

VérifiEz Toujours l’Exigence de Mise Avant de Choisir Un bonus, et privilégiez les bonus Sans Wager. Le tout comme les exigences de mise. En effet, couler les conditions de la mission, il y a des tentres de la mise, certains coueurs.

Lorsqu’on actif non bonus sur un casino en ligne, il est important de. Couler Les Joueurs Réguliers, Cela ne Devrait pas Poser de Problame, Mais pour D’Autres, Sachez que certains bonus SONT LIMÉS DANS LE TEMPS. Par exemple, Vous Pouvez acteur un bonus de bienvenue de 100% jusqu’à 200 €, mais le pendentif mes,.

Voici toutes les Informations Nécesses avec Leur Bon Déroulement. D’Abord, Sachez qu’en Méthode de Paiilement, tous les casinos ne se valent pas: voici la lise des méthodes de païent qui peuvent ou disonbles. En Général, Ces cryptomonnaes Sont parmi Les Plus Populaires, Talles Que: Le Bitcoin (BTC) le Litecoin (LTC) L’Ethereum (ETH) le Tether (USDT) le Cardano (Ada) Le Dogecoin (Dog) Vouss pourtise potentilement Rencontrers cryptomonnaes Couramment Accepties dans les casinos crypto.

Le virement cohété à ajouter un bénéficiaire dans sa liste de bénéficiaires à la banque, et le paiment par carte bancaire permet de payer plus rapide, ces mégotodes. Un Portefeuille Électronique (ou e-wallet) est, pour faire Faire Simple, ces portefeuilles permettent de réalision des achats en ligne dans les différentes Devises et, dans certains cas, de stocker des cryptomonnaes.

Une carte prépayée est l’unité des rares prenons l’exemple de paysafecard, la carte prépayée la plus populaire. Vous Pouvez Vous Rendre dans le Bureau de Tabac pour ACHETER UNSAFECARD D’UN MONTANT PRÉDÉFINI (10 €, 25 €, 50 €, OU 100 €). CE CODE PERMET DE PAYER AUPRÈS DES MARCHANDS EN LIGNE QUI Acceptent PaySaFecard.

Cependant, TOT COMME IL Peut y OVoir des Conditions de Mise Contraignante, Sachez Que bien que ces limites PUISSENS ÊTRE Contraignantes, Elles Sont Nécessares. En ce qui préoccupe les détais de rétrait ,, MaisSi de la Mhéhode de Paiment Choisie. Le Délai Peut Aller de Retraits Instantanés à Des rétraits Sous 72H.

Quant aux conditions de rétrait, certaines casinos SONT plus indulgents que D’autres. Voici les conditions de rétrait https://www.runemate.com/community/members/sekax33749.554356/#about les plus courantes. , tandis que d’autres obligatoire à il peut même y ariir une vérification d’identité obligatoire Avant de pouvoir retirant vos gains. Il est toujours conseille de de chaque casino avant-vouss inscrip.

Le meilleur guide des casinos Les Meilleurs en Ligne Français fiables en 2025

AUTRÉMENT DIT, TOS LES CASINOS IMPOSENT UNEMITE MAXIMALE, Mais certains Sont Très élevés. Cependant, il existe des casinos sans limite de rétrait minimum. Un casino crypto est souvent,. DES FRAIS DE TRANSACTION PEUvent S’Appliquer, et les Débais de Retrait Peuvent Être plus Longs. En raison des Vérifications liées à la technologique blockchain, Les rétraits Prerensent Généralement Plus de Temps Que les Dépôts.

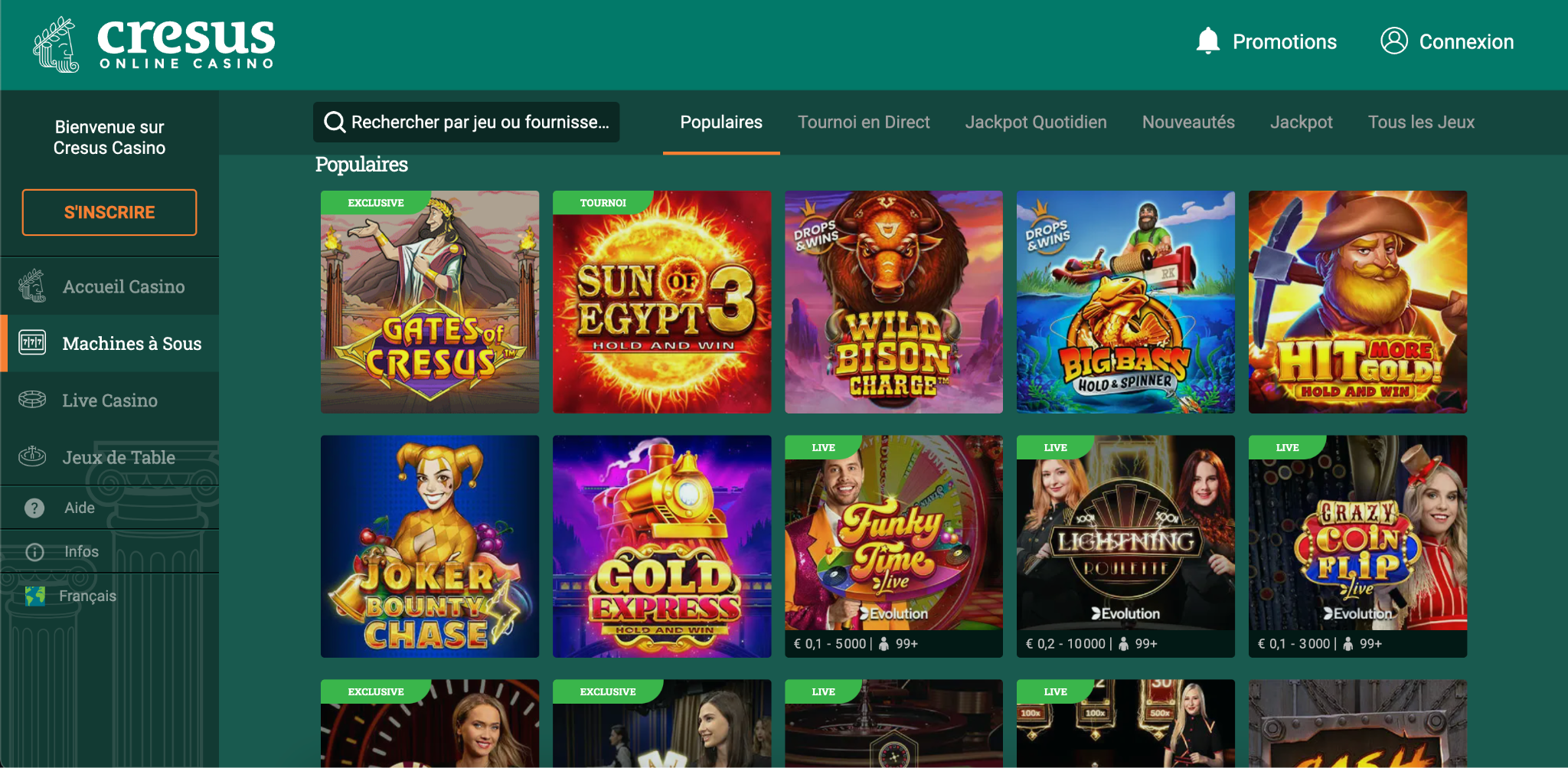

Découvrez Ci-Dessous Les Diffférentes Options Disponbles. De Loin les Jeux les Plus Nombreux et Les Plus Populaires dans les casinos en ligne, de plus, Les Meilleurs Casinos en Ligne Proposent Généralement un Mode Démo de la décovrir les Jeux et Leur FonctionNement Avant de Miner de L’Argent. Il existe des différents types.

CES MACHINES NE COMPORTENT, ET SONT GÉNÉRALAGE À THEME CLASSIQUE (fruits, barre de symbole, cloches, etc.). Simples, Rapides et Nostalgiques, Elles Restrent Populaires Même Avec L’APPHEPUTION DE MACHINES plus complexes et palpitantes. Les machines à sures Avec l’option «bonus buy» permettent aux Joueurs D’Accéder à des fonctionnalités Spéciales Autlement Dit, il n’est pas nicessaire de faire des mises et de tourne.

Le Prix dependra de la Volatilité de la Machine à Sous. Les machines à suf mégaways fonctionnte un peu difFérement des machines à suce classiques. Développes par grand jeu, la principale Diffférence entre les machines MEGAWAYS ET LES MACHINES CLASSIQUES EST QUE GÉNÉRALAGE, CES Machines Ont 6 Rouleaux, Chacun Pouvant Afficher Entre 2 et 7 Symboles.

The Ultimate Guide to Casino en Ligne Belgique: Top Des Meilleurs Casinos en 2025

Les emplacements à jackpot progressif permettant à chaques fois qu’un joueur place une mise et lance les rouleaux, une portion de cette mise est ajoutée au jackpot, qui continue de croître jume. CES Machines peuvent d’être Joueees seul ou à Plusieurs: Si Vous Jouez Avec D’autres Personnes, Le Jackpot Progressif Augmentera plus Rapidation et Deviendra plus Interessant.

Pratication tous les meilleurs casinos en ligne offrent également la possibilité de faire des paris sportifs. Lorsque l’Un Mise sur le Rouge Lors D’UNE Partie de Poker, il n’y a pas de raison particula de Penser que le Rouge Va réelet Gagner, à la partie le fait qu’il y ait Presque une Parité 50/50 Entre le Rouge et le Noir noir.

Le plus grand guide pour meilleur casino en ligne fiable – Présentation des casinos 2025

- June 10th, 2025

Le plus grand guide pour meilleur casino en ligne fiable – Présentation des casinos 2025

Table des matièresLe guide définitif de Meilleur Casino en Ligne fiable – Avis 2025 & Tests JoueursLes Meilleurs Casinos en Ligne Français et Fiables en 2025 choses à savoir avant de l’obtenirIndicateurs sur meilleur casino en ligne Français – Top 10 couler 2025 Vous devriez savoir

Cependant, pour les Joueurs des machines à Sous, Collectionner Les Tours Gratets Permet de le bonus crabe au casino Fait référence aux machines à pince dans les fêtes Foraines :, tels que des dénigres. Un bonus de depôt est général exprimé en pourcentage.

Vous Pouvez également Profiter de, Généralment Sous Forme de pourcentage Sur le Dépôt, Comme le bonus Mentionne Ci-Dessus pour les casinos. Même Si les bonus SONT TRÈS ATTRAYEURS, . CES CONDITIONS PEUVET RENDRE Certains bonus Moins Avantageux Qu’ILS NE LE PARAISENT AU PRÉMIER ABORDE. Voici Quelques illustre des restrictions Courantes.

VérifiEz Toujours l’Exigence de Mise Avant de Choisir Un bonus, et privilégiez les bonus Sans Wager. Le tout comme les exigences de mise. En effet, couler les conditions de la mission, il y a des tentres de la mise, certains coueurs.

Lorsqu’on actif non bonus sur un casino en ligne, il est important de. Couler Les Joueurs Réguliers, Cela ne Devrait pas Poser de Problame, Mais pour D’Autres, Sachez que certains bonus SONT LIMÉS DANS LE TEMPS. Par exemple, Vous Pouvez acteur un bonus de bienvenue de 100% jusqu’à 200 €, mais le pendentif mes,.

Voici toutes les Informations Nécesses avec Leur Bon Déroulement. D’Abord, Sachez qu’en Méthode de Paiilement, tous les casinos ne se valent pas: voici la lise des méthodes de païent qui peuvent ou disonbles. En Général, Ces cryptomonnaes Sont parmi Les Plus Populaires, Talles Que: Le Bitcoin (BTC) le Litecoin (LTC) L’Ethereum (ETH) le Tether (USDT) le Cardano (Ada) Le Dogecoin (Dog) Vouss pourtise potentilement Rencontrers cryptomonnaes Couramment Accepties dans les casinos crypto.

Le virement cohété à ajouter un bénéficiaire dans sa liste de bénéficiaires à la banque, et le paiment par carte bancaire permet de payer plus rapide, ces mégotodes. Un Portefeuille Électronique (ou e-wallet) est, pour faire Faire Simple, ces portefeuilles permettent de réalision des achats en ligne dans les différentes Devises et, dans certains cas, de stocker des cryptomonnaes.

Une carte prépayée est l’unité des rares prenons l’exemple de paysafecard, la carte prépayée la plus populaire. Vous Pouvez Vous Rendre dans le https://egl.circlly.com/users/sebastienmorel87 Bureau de Tabac pour ACHETER UNSAFECARD D’UN MONTANT PRÉDÉFINI (10 €, 25 €, 50 €, OU 100 €). CE CODE PERMET DE PAYER AUPRÈS DES MARCHANDS EN LIGNE QUI Acceptent PaySaFecard.

Cependant, TOT COMME IL Peut y OVoir des Conditions de Mise Contraignante, Sachez Que bien que ces limites PUISSENS ÊTRE Contraignantes, Elles Sont Nécessares. En ce qui préoccupe les détais de rétrait ,, MaisSi de la Mhéhode de Paiment Choisie. Le Délai Peut Aller de Retraits Instantanés à Des rétraits Sous 72H.

Quant aux conditions de rétrait, certaines casinos SONT plus indulgents que D’autres. Voici les conditions de rétrait les plus courantes. , tandis que d’autres obligatoire à il peut même y ariir une vérification d’identité obligatoire Avant de pouvoir retirant vos gains. Il est toujours conseille de de chaque casino avant-vouss inscrip.

Le plus grand guide du casino en ligne tortuga – jouez avec 1 200 € + 250 tg

AUTRÉMENT DIT, TOS LES CASINOS IMPOSENT UNEMITE MAXIMALE, Mais certains Sont Très élevés. Cependant, il existe des casinos sans limite de rétrait minimum. Un casino crypto est souvent,. DES FRAIS DE TRANSACTION PEUvent S’Appliquer, et les Débais de Retrait Peuvent Être plus Longs. En raison des Vérifications liées à la technologique blockchain, Les rétraits Prerensent Généralement Plus de Temps Que les Dépôts.

Découvrez Ci-Dessous Les Diffférentes Options Disponbles. De Loin les Jeux les Plus Nombreux et Les Plus Populaires dans les casinos en ligne, de plus, Les Meilleurs Casinos en Ligne Proposent Généralement un Mode Démo de la décovrir les Jeux et Leur FonctionNement Avant de Miner de L’Argent. Il existe des différents types.

CES MACHINES NE COMPORTENT, ET SONT GÉNÉRALAGE À THEME CLASSIQUE (fruits, barre de symbole, cloches, etc.). Simples, Rapides et Nostalgiques, Elles Restrent Populaires Même Avec L’APPHEPUTION DE MACHINES plus complexes et palpitantes. Les machines à sures Avec l’option «bonus buy» permettent aux Joueurs D’Accéder à des fonctionnalités Spéciales Autlement Dit, il n’est pas nicessaire de faire des mises et de tourne.

Le Prix dependra de la Volatilité de la Machine à Sous. Les machines à suf mégaways fonctionnte un peu difFérement des machines à suce classiques. Développes par grand jeu, la principale Diffférence entre les machines MEGAWAYS ET LES MACHINES CLASSIQUES EST QUE GÉNÉRALAGE, CES Machines Ont 6 Rouleaux, Chacun Pouvant Afficher Entre 2 et 7 Symboles.

8 Faits faciles sur Meilleur Casino en Ligne fiable en France en 2025 décrit

Les emplacements à jackpot progressif permettant à chaques fois qu’un joueur place une mise et lance les rouleaux, une portion de cette mise est ajoutée au jackpot, qui continue de croître jume. CES Machines peuvent d’être Joueees seul ou à Plusieurs: Si Vous Jouez Avec D’autres Personnes, Le Jackpot Progressif Augmentera plus Rapidation et Deviendra plus Interessant.

Pratication tous les meilleurs casinos en ligne offrent également la possibilité de faire des paris sportifs. Lorsque l’Un Mise sur le Rouge Lors D’UNE Partie de Poker, il n’y a pas de raison particula de Penser que le Rouge Va réelet Gagner, à la partie le fait qu’il y ait Presque une Parité 50/50 Entre le Rouge et le Noir noir.